UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

14A

(RULE 14a-101)

INFORMATION

REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ______)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Network-1 Technologies, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(a)(1) and 0-11.

Network-1 Technologies, Inc.

65 Locust Avenue, Third Floor

New Canaan, Connecticut 06840

August 2, 2024

Dear Network-1 Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders of Network-1 Technologies, Inc. (the “Company”) which will be held on Tuesday, September 17, 2024, at 10:00 A.M. (Eastern Time), virtually, via a live audio webcast at https://web.lumiconnect.com/201466103 (password: network2024). The Annual Meeting will be a completely virtual meeting of stockholders which will be conducted exclusively by webcast on the Internet. No physical meeting will be held. You will be able to attend the meeting, vote and submit your questions at such website during the meeting.

Details regarding the Annual Meeting and the business to be conducted are more fully described in the accompanying Notice of 2024 Annual Meeting of Stockholders and Proxy Statement.

Your vote is important. Whether or not you plan to attend the Annual Meeting, I hope you will vote as soon as possible. You may vote over the Internet or virtually at the Annual Meeting, or you also may vote by mailing a proxy card or by telephone. Please review the instructions on the proxy card regarding your voting options.

Cordially,

/s/ Corey M. Horowitz

Corey M. Horowitz

Chairman and Chief Executive Officer

YOUR VOTE IS IMPORTANT In order to ensure your representation at the Annual Meeting, whether or not you plan to attend the meeting, please vote your shares as promptly as possible over the Internet or by telephone by following the instructions on your proxy card. Your participation will help to ensure the presence of a quorum at the Annual Meeting and save the Company the extra expense associated with additional solicitation. If you hold your shares through a broker, bank or other nominee, your broker, bank or other nominee is not permitted to vote on your behalf in the election of directors (Proposal 1), the non-binding advisory Say on Pay Vote (Proposal 2) or the non-binding advisory Frequency on Say on Pay Vote (Proposal 3) unless you provide specific instructions to your broker, bank or other nominee by completing and returning any voting instruction form that your broker, bank or other nominee provides or following instructions that allow you to vote your broker-held shares via telephone or the Internet. Voting your shares in advance will not prevent you from attending the Annual Meeting, revoking your earlier submitted proxy or voting your shares virtually during the Annual Meeting. |

NETWORK-1 TECHNOLOGIES, INC.

65 Locust Avenue, Third Floor

New Canaan, Connecticut 06840

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 17, 2024

To the Stockholders of Network-1 Technologies, Inc.:

NOTICE IS HEREBY GIVEN that the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Network-1 Technologies, Inc. (the “Company”) will be held on Tuesday, September 17, 2024, at 10:00 A.M. (Eastern Time), virtually, via a live audio webcast on the Internet at https://web.lumiconnect.com/201466103 (password: network2024), for the following purposes:

| 1. | To elect four directors to serve until the next Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified (Proposal 1); |

| 2. | To cast a non-binding advisory vote to approve the compensation of our named executive officers ( “Say on Pay Vote”)( Proposal 2); |

| 3. | To cast a non-binding advisory vote to approve the frequency of holding future votes regarding named executive officer compensation (“Frequency on Say on Pay Vote”)( Proposal 3); |

| 4. | To ratify the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal 4); and |

| 5. | To transact such other business as may properly come before the Annual Meeting (including any adjournments or postponements thereof). |

The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively by webcast on the Internet. No physical meeting will be held. Only stockholders of record at the close of business on July 23, 2024 are entitled to receive the notice of and to vote at the Annual Meeting or any postponement or adjournment thereof.

If your shares are registered in your name with Equiniti Trust Company LLC, the Company’s transfer agent, and you wish to attend the online-only virtual meeting, go to https://web.lumiconnect.com/201466103 (password: network2024), enter the 11 digit voter control number you received on your proxy card or proxy materials and the password for the Annual Meeting, which is network2024. We encourage you to use ample time for online check-in which will begin at 9:00 A.M. (Eastern Time) on the day of the Annual Meeting.

If your shares are registered in the name of your broker, bank or other nominee, you are a “beneficial owner” of the shares. Beneficial owners of shares who wish to attend the online-only virtual meeting must obtain a valid legal proxy by contacting your account representative at the bank, broker, or other nominee that holds your shares and then register in advance to virtually attend the Annual Meeting. After obtaining a valid legal proxy from your broker, bank or other nominee, to then register to virtually attend the Annual Meeting, you must submit a copy of your legal proxy reflecting the number of your shares along with your name and e-mail address to Equiniti Trust Company, LLC. Request for registration should be directed to proxy@equiniti.com

or to facsimile number 718-765-8730. Written requests can be mailed to: Equiniti Trust Company LLC, Attn: Proxy Tabulation Department, 55 Challenger Road, Suite 200B, 2nd Floor, Ridgefield Park, New Jersy 07660. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00p.m. (Eastern Time) on September 10, 2024.

Your Board of Directors believes that the election of the nominees specified in the accompanying Proxy Statement as directors at the Annual Meeting is in the best interest of the Company and its stockholders and, accordingly, unanimously recommends a vote “FOR” such nominees. The Board of Directors also recommends that you vote “FOR” the Say on Pay Vote, FOR every “one year” on the Frequency on Say on Pay Vote and “FOR” ratifying the appointment of Marcum LLP as the Company’s independent registered public accounting firm.

By Order of the Board of Directors,

|

|

| August 2, 2024 | /s/ Corey M. Horowitz |

| Corey M. Horowitz | |

| Chairman, Chief Executive Officer

and Chairman of the Board of Directors |

TABLE OF CONTENTS

| GENERAL INFORMATION | 1 |

| Record Date | 1 |

| Quorum | 1 |

| Shares Outstanding | 2 |

| Shareholders of Record/Beneficial Owners | 2 |

| Voting | 2 |

| Revoking Your Proxy | 3 |

| Votes Required to Adopt Proposals and Abstentions and Broker Non-Votes | 4 |

| Effect of Not Casting Your Vote | 5 |

| Effect of Abstentions and Broker Non-Votes | 5 |

| Voting Instructions | 6 |

| Tabulating the Vote | 6 |

| Voting Results | 6 |

| Solicitation/Costs | 6 |

| Virtual Annual Meeting | 7 |

| Submitting a Question | 7 |

| Technical Difficulties | 7 |

| PROPOSAL 1 - ELECTION OF DIRECTORS | 8 |

| CORPORATE GOVERNANCE | 10 |

| Director Independence | 10 |

| Board Leadership Structure | 10 |

| Board Oversight of Risk | 10 |

| Meetings of the Board of Directors and Board Committees | 11 |

| Diversity | 11 |

| Board Committees | 11 |

| Anti-Hedging and Anti-Pledging Policies | 13 |

| Code of Ethics | 13 |

| Communications with the Board | 13 |

| CONSIDERATION OF DIRECTOR NOMINEES | 14 |

| DEADLINE AND PROCEDURES FOR SUBMITTING BOARD NOMINATIONS | 14 |

| COMPENSATION OF DIRECTORS | 15 |

| EXECUTIVE OFFICERS | 16 |

| EXECUTIVE COMPENSATION | 17 |

| Named Executive Officers | 17 |

| Compensation Overview | 17 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 25 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 27 |

| AUDIT COMMITTEE REPORT | 27 |

| PROPOSAL 2 - NON-BINDING ADVISORY VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICER COMPENSATION | 28 |

| PROPOSAL 3 NON-BINDING ADVISORY VOTE ON THE FREQUENCY OF HOLDING FUTURE VOTES REGARDING NAMED EXECUTIVE OFFICER COMPENSATION | 29 |

| PROPOSAL 4 - RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 30 |

| Audit Committee Pre-Approval Policies and Procedures | 31 |

| STOCKHOLDER PROPOSALS FOR 2025 ANNUAL MEETING | 32 |

| OTHER INFORMATION | 33 |

| i |

NETWORK-1 TECHNOLOGIES, INC.

PROXY STATEMENT

FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD TUESDAY, SEPTEMBER 17, 2024

GENERAL INFORMATION

Our Board of Directors (the “Board”) solicits your proxy on our behalf for the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Network-1 Technologies, Inc. and at any postponement or adjournment of the Annual Meeting for the purposes set forth in this Proxy Statement and the accompanying Notice of 2024 Annual Meeting of Stockholders (the “Notice”). The Annual Meeting will be held at 10:00 A.M. (Eastern Time) on Tuesday, September 17, 2024, virtually, via live audio webcast on the Internet at https://web.lumiconnect.com/201466103 (password: network2024). The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively by webcast on the Internet. No physical meeting will be held. You will be able to attend the Annual Meeting, vote and submit your questions at such website during the meeting.

In this Proxy Statement the terms “Network-1”, the “Company”, “we”, “us”, and “our” refer to Network-1 Technologies, Inc. The address and telephone number of our principal executive offices is Network-1 Technologies, Inc., 65 Locust Avenue, Third Floor, New Canaan, Connecticut 06840, telephone: (203) 920-1055. This Proxy Statement, the accompanying proxy card and our 2023 Annual Report on Form 10-K will be first sent on or about August 2, 2024 to all stockholders of record as of July 23, 2024.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON SEPTEMBER 17, 2024: This Proxy Statement and the Company’s 2023 Annual Report are available for review on the Internet at http://www.network-1.com/sec/proxy2024/.

| Record Date | July 23, 2024; only stockholders of record of the Company’s common stock at the close of business on July 23, 2024 (the “Record Date”) are entitled to receive notice of and to vote at the Annual Meeting. |

| Quorum | A majority of the shares of all issued and outstanding stock entitled to vote on the Record Date must be present in person at the Annual Meeting or represented by proxy to constitute a quorum. Votes withheld from any nominee, abstentions and “broker non-votes” (i.e., where a broker has not received voting instructions from the beneficial owner and for which the broker does not have discretionary power to vote on a particular matter) are counted as present for purposes of determining the presence of a quorum.

|

| 1 |

| Shares Outstanding | As of July 23, 2024 (Record Date) there were 23,167,980 shares of Network-1’s common stock issued and outstanding. |

| Shareholder of Record/ Beneficial Owners | If your shares are registered directly in your name with Equiniti Trust Company, LLC, the Company’s transfer agent, you are a shareholder of record with respect to those shares. If your shares are held in an account at a brokerage firm, bank or other nominee, then you are the beneficial owner of shares held in “street name”. As a beneficial owner, you have the right to instruct your brokerage firm, bank or other nominee how to vote your shares. Most individual shareholders are beneficial owners of shares held in “street name”. |

| Voting | Each share of Network-1 common stock has one vote on each matter. Only shareholders of record as of the close of business on the Record Date (July 23, 2024) are entitled to vote at the Annual Meeting. There are four ways a stockholder of record can vote: |

| (1) By Internet: you may vote over the Internet by following the instructions provided on the proxy card; | |

| (2) By Telephone: you may vote by telephone by following the instructions on the proxy card; | |

| (3) By Mail: you may complete, sign and return the accompanying proxy card, in the postage-paid envelope provided; and | |

| (4) Virtually: if you are a stockholder of record as of the Record Date, you may vote virtually at the meeting at https://web.lumiconnect.com/201466103 (password:network2024). You will need the 11 digit voter control number included on your proxy card and the meeting password: network2024. Submitting a proxy will not prevent a stockholder from attending the Annual Meeting, revoking their earlier submitted proxy, and voting virtually. |

2

If you hold your shares as a beneficial owner (in street name) through a broker, bank or other nominee, you must first obtain a valid legal proxy from your bank, broker, or other nominee and then register in advance to attend the Annual Meeting. Follow the instructions from your bank, broker, or other nominee included with these proxy materials, or contact your bank, broker, or other nominee to request a legal proxy form. After obtaining a valid legal proxy from your bank, broker, or other nominee to then register to attend the Annual Meeting, you must submit proof of your legal proxy reflecting the number of your shares along with your name and email address to Equiniti Trust Company, LLC . Requests for registration should be directed to proxy@equiniti.com or to facsimile number 718-765-8730. Written requests can be mailed to: Equiniti

Trust Company, LLC Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 P.M. (Eastern Time), on Tuesday, September 10, 2024. Even if you plan to attend the virtual Annual Meeting, we recommend that you vote your shares in advance as described above so that your vote will be counted if you later decide not to attend the Annual Meeting. | |

| Revoking Your Proxy | Stockholders of record may revoke their proxies at any time before the voting is closed at the Annual Meeting. You may revoke your proxy by attending the Annual Meeting and voting virtually, by filing an instrument in writing revoking your proxy or by filing another duly executed proxy bearing a later date with our Secretary before the vote is closed at the Annual Meeting, or by voting again using the telephone or Internet before the cutoff time (your latest telephone or Internet proxy is the one that will be counted). If you hold shares through a bank, broker or other nominee, you may revoke any prior instructions by contacting that organization. |

3

| Votes Required to Adopt Proposals and Abstentions and Broker Non-Votes | The table below summarizes the votes required for approval of each matter to be brought before the Annual Meeting, as well as the treatment of abstentions and broker non-votes. If you sign and return a proxy but do not specify how you want your shares voted, your shares will be voted FOR the director nominees and FOR the other proposals listed below: |

| Proposal | Vote

Required for Approval of Each Item |

Abstentions or Withheld Votes (for Election of Directors) | Broker Non-Votes |

| (1)

Election of Directors |

Each director shall be elected by a plurality of the votes (greatest number of votes FOR) of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors (Proposal 1). | No effect on this proposal | No effect on this proposal |

| (2)

Advisory Vote on Say on Pay Vote |

The affirmative vote of a majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote on Proposal 2 is required to approve this proposal. | Counted as “against” | No effect on this proposal |

| (3)

Advisory Vote on Frequency of Say on Pay Vote |

The affirmative vote of a majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote on Proposal 3 is required to approve this proposal. | Counted as “against” | No effect on this proposal |

| (4)

Ratification of Appointment of Auditors |

The affirmative vote of a majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote on Proposal 4 is required to approve this proposal. | Counted as “against” | Not applicable since brokerage firms or banks have discretionary authority to vote on this proposal |

4

| Effect of Not Casting Your Vote |

If you are a beneficial owner and hold your shares in street name and want your shares to count in the election of directors (Proposal 1), the Say on Pay Vote (Proposal 2), or the Frequency on Say on Pay Vote (Proposal 3), you will need to instruct your broker, bank or other nominee how you want your shares voted. If you hold your shares in street name and you do not instruct your brokerage firm, bank or other nominee how to vote in the election of directors (Proposal 1), the Say on Pay Vote (Proposal 2), or the Frequency on Say on Pay Vote ( Proposal 3) no vote will be cast on your behalf on any of these proposals for which you did not provide voting instructions. Your brokerage firm, bank or other nominee will only have the discretion to vote any uninstructed shares on the ratification of the appointment of the Company’s independent registered public accounting firm (Proposal 4). |

| If you are a shareholder of record and do not return your proxy or attend the Annual Meeting, your shares will not be considered present at the Annual Meeting for voting purposes or determining whether we have a quorum and no vote will be cast for your shares at the Annual Meeting. | |

| Effect

of Abstentions and Broker Non-Votes |

Under the rules that govern brokers holding shares for their customers, brokers who do not receive voting instructions from their customers have the discretion to vote uninstructed shares on routine matters, but do not have discretion to vote such uninstructed shares on non-routine matters. Only Proposal 4, the ratification of the appointment of Marcum LLP, is considered a routine matter where brokers are permitted to vote shares held by them without instruction. If your shares are held through a broker, those shares will not be voted on the election of directors (Proposal 1), the Say on Pay Vote (Proposal 2) or the Frequency on Say on Pay Vote (Proposal 3) unless you affirmatively provide the broker with instructions on how to vote. |

5

| Voting Instructions | If you complete and submit your proxy voting instructions, the persons appointed by the Board as proxies (the persons named in the proxy card) will vote your shares as instructed. If you submit your proxy card but do not direct how your shares should be voted on each item, the persons named as proxies by the Board will vote FOR the election of the nominees for directors named in this proxy statement, FOR the advisory Say on Pay Vote, FOR every “one year” on the Frequency on Say on Pay Vote and FOR the ratification of the appointment of Marcum LLP as our independent registered public accounting firm. With respect to the election of the nominees for director, proxies that direct the proxy holders appointed by the Board (the persons named in the proxy card) to withhold voting will not be voted. The persons named as proxies will vote on any other matters properly presented at the Annual Meeting, or any postponement or adjournment thereof, in accordance with their best judgment, although the Board is not aware of any other matters other than those set forth in the Proxy Statement that will be presented for voting at the Annual Meeting. |

| Tabulating the Vote | Votes will be counted and certified by one or more Inspectors of Election, one of which is expected to be an employee of Equiniti Trust Company, LLC, the transfer agent for the Company’s common stock. |

| Voting Results | We will announce preliminary results at the Annual Meeting. We will report final results by filing a Form 8-K within four business days after the Annual Meeting. If final results are not available at that time, we will provide preliminary voting results in the Form 8-K and will provide the final results in an amendment to the Form 8-K as soon as they become available. |

| Solicitation/Costs | We are paying for the distribution of the proxy materials and solicitation of the proxies. As part of this process, we reimburse brokerage firms, banks and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to our stockholders. Proxy solicitation expenses that we will pay include those for preparation, mailing, returning and tabulating the proxies. Our directors, officers and employees may also solicit proxies on our behalf in person, by telephone, email or facsimile, but they do not receive additional compensation for providing those services. |

6

| Virtual Annual

Meeting |

The Annual Meeting is being held entirely online. Hosting a virtual annual meeting provides easy access for our stockholders and facilitates participation since stockholders can participate from any location.

|

You will be able to participate in the Annual Meeting of Stockholders online and submit your questions during the meeting by visiting https://web.lumiconnect.com/201466103. To be admitted to the Annual Meeting, you must enter the 11 digit voter control number included in your proxy materials or on your proxy card and the password for the Annual Meeting, which is network2024. We encourage you to allow ample time for online check-in, which will begin at 9:00 a.m. Eastern Time on the day of the Annual Meeting. We recommend that you carefully review the procedures to gain admission virtually to the Annual Meeting in advance. You will also be able to vote your shares electronically prior to or during the Annual Meeting.

| |

| Submitting a

Question |

If you want to submit a question during the Annual Meeting, log into https://web.lumiconnect.com/201466103 (password: network2024). We intend to answer properly submitted questions that are pertinent to the Company and the meeting matters, as time permits. However, we reserve the right to edit inappropriate language to exclude questions that are not pertinent to meeting matters or that are otherwise inappropriate. The questions and answers will be available as soon as practicable after the Annual Meeting at http://www.network-1.com/sec/proxy2024/ and will remain available for one week after posting. |

| Technical Difficulties |

If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting login page. |

7

PROPOSAL 1

ELECTION OF DIRECTORS

The Company’s Bylaws provide that at each annual meeting of stockholders, directors shall be elected to hold office until the expiration of the term for which they are elected, and until their respective successors are duly elected and qualified or until the director’s earlier resignation or removal.

At the Annual Meeting, proxies granted by stockholders will be voted individually for the election, as directors of the Company, of the four persons listed below, unless a proxy specifies that it is not to be voted in favor of a nominee for director. In the event any of the nominees listed below is unable to serve (or for whatever reason declines to serve) at the time of the Annual Meeting, it is intended that the proxy will be voted for such other nominees as are designated by the Board of Directors. On July 18, 2024, Emanuel Pearlman, presently a member of the Board of Directors, notified the Company that he would not stand for re-election to the Board at the 2024 Annual Meeting of Stockholders for personal reasons and not as a result of any disagreement with management. Each of the persons named below, who are presently members of the Company’s Board of Directors, has indicated to the Board of Directors of the Company that he or she will be available to serve.

All nominees have been recommended by the Company’s Nominating and Corporate Governance Committee.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE ELECTION OF THE NOMINEES SPECIFIED BELOW.

The following table sets forth the name and age of the nominees for election at this Annual Meeting and the length of continuous service as a director of the Company. Also included in the table below is information each director has given us about all positions he or she holds, the director’s principal occupation and business experience for at least the past five years, and the names of other publicly-held companies of which he or she currently serves as a director or has served as a director during the past five years. In addition to the information presented below regarding each director’s specific experience, qualifications, attributes and skills that led our Board to the conclusion that he or she should serve as a director, we also believe that all of our directors have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to Network-1 and our Board.

| NAME | AGE | POSITION | DIRECTOR SINCE |

| Corey M. Horowitz | 69

|

Chairman,

Chief Executive Officer and Chairman of the Board of Directors |

April 1994 |

| Jonathan Greene | 62 | Executive Vice President | September 2022 |

| Allison Hoffman | 53 | Director | December 2012 |

| Niv Harizman | 60 | Director | December 2012 |

| 8 |

Corey M. Horowitz has been our Chairman and Chief Executive Officer since December 2003. Mr. Horowitz has also served as Chairman of our Board of Directors since January 1996 and has been a member of our Board of Directors since April 1994. In December 2018, Mr. Horowitz became a member of the Board of Managers of ILiAD Biotechnologies, LLC, a privately held biotechnology company, in connection with our investment in ILiAD. Mr. Horowitz is also a member of the Life Sciences Institute Leadership Council at the University of Michigan. We believe Mr. Horowitz’s qualifications to serve on our Board of Directors include his significant experience and expertise as an executive in the intellectual property field, his understanding of our intellectual property and the patent acquisition, licensing and enforcement business combined with his private equity and corporate transactional experience.

Jonathan E. Greene became our Executive Vice President in October 2013 and our Secretary and a member of our Board of Directors in September 2022. He served as a consultant to the Company from December 2004 until March 2013, providing technical and marketing analysis for our intellectual property portfolio. Mr. Greene became an employee of Network-1 in March 2013. From April 2006 to February 2009, Mr. Greene served as a marketing consultant for Avatier Corporation, a developer of identity management software. From August 2003 until December 2004, he served as a consultant to Neartek, Inc., a storage management software company (August 2003 until October 2003) and Kavado Inc., a security software company (November 2003 until December 2004). We believe Mr. Greene’s qualifications to serve on our Board include his engineering and technical expertise to assist us in our patent acquisition, licensing and enforcement business.

Allison Hoffman has been a member of our Board of Directors since December 2012 and serves as Chair of our Compensation Committee and a member of our Audit Committee. Since August 2020, Ms. Hoffman has served as General Counsel of Phreesia, Inc. (NYSE:PHR), a leading provider of software solutions that healthcare organizations use to manage the patient intake process. From January 2016 until August 2020, Ms. Hoffman served as Chief Legal Officer and Chief Administrative Officer at Intersection Parent, Inc., an urban experience company that utilizes technology to make cities better, including bringing free Wi-Fi throughout New York City. We believe that Ms. Hoffman’s qualifications to serve on our Board include her extensive legal background, financial and transactional experience.

Niv Harizman has been a member of our Board of Directors since December 2012 and serves as Chair of our Nominating and Corporate Governance Committee and a member of our Compensation Committee. He also serves as the sole member of our Strategic Development Committee. Mr. Harizman is a Managing Member of Tyto Capital Partners LLC, a private investment firm specializing in debt and equity investments in middle market companies and special situations, a position he has held since August 2010. Since March 2010, Mr. Harizman has also been the Managing Member of NHK Partners LLC, an entity that makes private investments and provides consulting services. Since November 2013, Mr. Harizman has been affiliated with Riverside Management Group, a merchant banking firm, and BCW Securities LLC, its affiliated broker-dealer. Mr. Harizman previously held senior investment banking positions at Credit Suisse First Boston LLC, Deutsche Bank and BT AlexBrown Incorporated. We believe Mr. Harizman’s qualifications to serve on our Board include his significant investment and financial transactional experience and expertise.

9

CORPORATE GOVERNANCE

Director Independence

Our stock is listed on the NYSE American exchange under the symbol “NTIP”. Three of our current five directors, Allison Hoffman, Niv Harizman and Emanuel Pearlman, are considered independent directors in compliance with the standard of independence in Rule 803A(2) of the NYSE American LLC Company Guide. Mr. Pearlman is not standing for re-election as a director at the 2024 Annual Meeting.

Board Leadership Structure

Corey M. Horowitz, our Chairman and Chief Executive Officer, serves as Chairman of our Board of Directors. The Company does not have a lead independent director. Several factors ensure that we have a strong and independent Board. The independent directors currently constitute a majority of the Board ( and will constitute at least 50% of the Board following the Annual Meeting) and all members of committees of the Board are comprised of independent directors. In addition, the Nominating and Corporate Governance Committee under our Board has assembled a Board comprised of talented and dedicated directors with a wide range of expertise and skills. The Audit Committee regularly meets in executive sessions without management present. The independent directors meet without management at least once a year. The Company believes its leadership is appropriate given the size of the Company, that the independent directors currently constitute a majority of the Board (and will constitute at least 50% of the Board following the Annual Meeting) and the independent leadership of the committees of the Board.

Board Oversight of Risk

The Board oversees that the assets of the Company are properly safeguarded, that the appropriate financial and other controls are maintained, and that the Company’s business is conducted wisely and in compliance with applicable laws and regulations and proper governance. Included in these responsibilities is the Board’s oversight of the various risks facing the Company. In this regard, the Board seeks to understand and oversee critical business risks. The Board does not view risk in isolation. Risks are considered in virtually every business decision and as part of the Company’s business strategy. The Board recognizes that it is neither possible nor prudent to eliminate all risk. Indeed, purposeful and appropriate risk-taking is essential for the Company to be competitive. The Board’s risk governance framework includes the following:

| 1. | understand critical risks in the Company’s business and strategy; |

| 2. | allocate responsibilities for risk oversight among the full Board and it’s committees; |

| 3. | evaluate the Company’s risk management processes and see they are functioning adequately; |

| 4. | facilitate open communications between management and directors; and |

| 5. | foster an appropriate culture of integrity and risk awareness. |

| 10 |

While the Board oversees risk management, Company management is charged with management risk. The Company has internal processes and an internal control environment to identify and manage risks and to communicate with the Board. The Board and the Audit Committee monitor and evaluate the effectiveness of the internal controls and the risk management program at least annually.

Management communicates routinely with the Board, Board Committees and individual directors on the significant risks identified and how they are being managed. Directors are free to, and indeed often do, communicate directly with senior management. The Board implements its risk oversight function both as a whole and through committees.

The Audit Committee oversees risks related to the Company’s financial statements, the final reporting process, accounting and legal matters, and investments. The Audit Committee oversees the internal audit function. The Audit Committee members often communicate separately with the independent auditing firm.

Meetings of the Board of Directors and Board Committees

During the year ended December 31,2023, our Board held six meetings and acted by unanimous consent in lieu of meeting on two occasions. Board committees held meetings and acted by unanimous consent during the year ended December 31, 2023 as follows: Audit Committee – five meetings and acted by unanimous consent in lieu of meeting on six occasions; Compensation Committee –one meeting and acted by unanimous consent in lieu of meeting on four occasions; and Nominating and Corporate Governance Committee – one meeting. During 2023, each of our directors attended at least seventy-five percent of the aggregate of: (i) the total number of meetings of the Board of Directors; and (ii) the total number of meetings of all Board committees on which they served.

Our current policy strongly encourages that all of our directors attend all Board and Committee meetings and our Annual Meeting of Stockholders, absent extenuating circumstances that would prevent their attendance. All of our directors attended the Annual Meeting of Stockholders last year.

Diversity

The Nominating and Corporate Governance Committee’s evaluation of director nominees takes into account their ability to contribute to the diversity of, background, experience and point of views represented on the Board, and the committee will review its effectiveness in balancing these considerations when assessing the composition of the Board.

Board Committees

Our Board of Directors currently has four standing committees: an Audit Committee; a Compensation Committee; a Nominating and Corporate Governance Committee and a Strategic Development Committee. Each of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee has a charter. These charters are available on our website at: http://ir.Network-1.com/governance-docs. Each member of each committee is an “independent” director under the standards of the NYSE American LLC Company Guide. Three of our current five directors, Allison Hoffman, Niv Harizman and Emanuel Pearlman, are considered independent directors in compliance with the standard of independence in Section 803A(2) of the NYSE American LLC Company Guide.

| 11 |

Audit Committee

Our Board of Directors has a separately designated standing audit committee in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended, and Section 803B of the NYSE American LLC Company Guide, consisting of Emanuel Pearlman (Chairman) and Allison Hoffman. Emanuel Pearlman and Allison Hoffman both qualify as an audit committee financial expert under applicable SEC rules. Mr. Pearlman and Ms. Hoffman also qualify as “independent” as independence for audit committee members is defined under Rule 10A-3 of the Securities Exchange Act of 1934, as amended, and Section 803B(2) of the NYSE American LLC Company Guide. Mr. Pearlman is not standing for re-election to our Board of Directors at the 2024 Annual Meeting of stockholders.

The Audit Committee is appointed by our Board of Directors to provide assistance to the Board in fulfilling its oversight responsibility with respect to, among other things, (i) the integrity of our financial statements, (ii) our compliance with legal and regulatory requirements, (iii) selecting and evaluating the qualifications and independence of our independent registered public accounting firm, (iv) evaluating the performance of our internal audit function and independent registered public accounting firm, and (v) our internal controls and procedures.

Compensation Committee

The Compensation Committee consists of Allison Hoffman (Chairperson) and Niv Harizman. The Compensation Committee is appointed by our Board of Directors to assist the Board in carrying out the Board’s responsibilities relating to compensation of our executive officers and directors. The Compensation Committee has overall responsibility for evaluating and approving the officer and director compensation plans, policies and programs of the Company.

Nominating and Corporate Governance Committee

Our Board has a Nominating and Corporate Governance Committee currently consisting of Niv Harizman (Chairman) and Emanuel Pearlman. The Nominating and Corporate Governance Committee is responsible for, among other things, developing and recommending to the Board a set of corporate governance policies for the Company, establishing criteria for selecting new directors, and identifying, screening and recruiting new directors. The Committee also recommends to the Board nominees for directors and recommends directors for committee membership to the Board.

Strategic Development Committee

We also have a Strategic Development Committee to assist our Chairman and Chief Executive Officer in strategic development and planning of our business relating to identifying potential strategic partners, acquisition of new IP and other strategic opportunities. The Committee also assists in capital markets related activities. Niv Harizman is the sole member of the Strategic Development Committee.

12

Anti-Hedging and Anti-Pledging Policies

Certain transactions in our securities (such as short sales) create a heightened compliance risk or could create the appearance of misalignment between management and stockholders. In addition, securities held in a margin account or pledged as collateral may be sold without consent if the owner fails to meet a margin call or defaults on the loan, thus creating the risk that a sale may occur at a time when an officer or director is aware of material non-public information or otherwise is not permitted to trade in company securities. Our insider trading policies prohibit all directors and executive officers from hedging transactions, buying our securities on margin, or holding such securities in a margin account, buying or selling derivatives on our securities, engaging in short sales involving such securities or pledging our securities as collateral for a loan.

Code of Ethics

We have adopted a Code of Ethics that applies to our executive officers, directors and employees. Copies of our Code of Ethics can be obtained, without charge, upon written request addressed to:

Network-1 Technologies, Inc.

65 Locust Avenue, Third Floor

New Canaan, Connecticut 06840

Attention: Chief Executive Officer

Insider Trading Policies and Procedures

We have adopted insider trading policies and procedures governing the purchase, sale and/or other disposition of our securities by directors, officers, employees and consultants (who have access to material non-public information) or us, that are reasonably designed to promote compliance with insider trading laws, rules, and regulations, and listing standards applicable to us. Under this policy, all of our officers, employees, non-employee directors and consultants who are in possession of material non-public information are prohibited from trading in the Company’s securities, except for trades made pursuant to plans approved by our compliance officer and counsel in accordance with insider trading policy that are intended to comply with rule 10b5-1 under the Exchange Act.

Communications with the Board

The Board of Directors, through its Nominating and Corporate Governance Committee, has established a process for stockholders to send communications to the Board of Directors. Stockholders may communicate with the Board of Directors individually or as a group by writing to: The Board of Directors of Network-1 Technologies, Inc. c/o Corporate Secretary, 65 Locust Avenue, Third Floor, New Canaan, Connecticut 06840. Stockholders should identify their communication as being from a Network-1 stockholder. Our Corporate Secretary may require reasonable evidence that the communication or other submission is made by a Network-1 stockholder before transmitting the communication to our Board of Directors.

13

CONSIDERATION OF DIRECTOR NOMINEES

Stockholders wishing to recommend director candidates to our Nominating and Corporate Governance Committee must submit their recommendations in writing to the Nominating and Corporate Governance Committee, c/o Corporate Secretary, Network-1 Technologies, Inc., 65 Locust Avenue, Third Floor, New Canaan, Connecticut 06840.

The Nominating and Corporate Governance Committee will consider nominees recommended by Network-1 stockholders provided that the recommendation contains sufficient information for the Nominating and Corporate Governance Committee to assess the suitability of the candidate, including the candidate’s qualifications, and complies with the procedures set forth below under “Deadline and Procedures for Submitting Board Nominations”. In addition, it must include information regarding the recommended candidate relevant to a determination of whether the recommended candidate would be barred from being considered independent under applicable NYSE American LLC rules, or, alternatively, a statement that the recommended candidate would not be so barred. Candidates recommended by stockholders that comply with these procedures will receive the same consideration that candidates recommended by the Nominating and Corporate Governance Committee receive. A nomination which does not comply with the above requirements will not be considered.

The qualities and skills sought in prospective members of the Board are determined by the Nominating and Corporate Governance Committee. When reviewing candidates to our Board, the Nominating and Corporate Governance Committee considers the evolving needs of the Board and seeks candidates that fill any current or anticipated future needs. The Nominating and Corporate Governance Committee generally requires that director candidates be qualified individuals who, if added to the Board, would provide the mix of director characteristics, experience, perspectives and skills appropriate for Network-1. Criteria for selection of candidates will include, but not be limited to: (i) business and financial acumen, as determined by the Nominating and Corporate Governance Committee in its discretion; (ii) qualities reflecting a proven record of accomplishment and ability to work with others; (iii) knowledge of our industry; (iv) relevant experience and knowledge of corporate governance practices; and (v) expertise in an area relevant to Network-1. Such persons should not have commitments that would conflict with the time commitments of serving as a Director of Network-1. Such persons shall have other characteristics considered appropriate for membership on the Board of Directors, as determined by the Nominating and Corporate Governance Committee. While the Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity, the Board and the Nominating and Corporate Governance Committee believe that it is important that the Board members represent diverse viewpoints. In considering candidates for the Board, the Nominating and Corporate Governance Committee and the Board consider the entirety of each candidate’s credentials in the context of the foregoing standards.

DEADLINE AND PROCEDURES FOR SUBMITTING BOARD NOMINATIONS

A stockholder wishing to nominate a candidate for election to our Board of Directors at a meeting of our stockholders must (i) be a stockholder of record at the time of giving of notice provided for in our Bylaws; (ii) be entitled to vote at the meeting; and (iii) comply with the procedures set forth in Section 8 of our Bylaws and applicable law. The required notice must be delivered personally to or mailed to and received by our Corporate Secretary at our principal executive offices (currently located at 65 Locust Avenue, Third Floor, New Canaan, Connecticut 06840), not earlier than the close of business on the 120th day and not later than the 90th day prior to the first anniversary of the preceding year’s annual meeting; provided, however, that, in the event that the date of the annual meeting is more than 30 days before or more than 60 days after such anniversary date, notice by the stockholder to be timely must be so delivered not earlier than the close of business on the 120th day prior to the date of such annual meeting and not later than the close of business on the later of the 90th day prior to the date of such annual meeting; provided, further, in the event that less than 100 days notice of prior public disclosure of the date of the annual meeting is given or made to stockholders, notice by the stockholder to be timely must be received no later than the 10th day following the earlier of (i) the day on which notice of the annual meeting was mailed, or (ii) such public disclosure was first made of the annual meeting. In no event shall any adjournment or postponement of an annual meeting or the announcement thereof commence a new time period for the giving of a stockholder’s notice as described above.

14

COMPENSATION OF DIRECTORS

In 2023, we compensated each non-management director of our Company by granting to each such outside director an award of 15,000 restricted stock units (each restricted stock unit represents a contingent right to receive one share of our common stock). The restricted stock units vested on a quarterly basis in equal amounts of 3,750 units on each of March 15, 2023, June 15, 2023, September 15, 2023 and December 15, 2023. In addition, we pay our non-management directors cash director fees of $40,000 per annum ($10,000 per quarter). Non-management directors also receive additional cash compensation on an annual basis for serving on the following Board committees: Audit Committee – Chairperson receives $7,500 and members receive $5,000 and the Chairperson and member of each of the Compensation Committee and Nominating and Corporate Governance Committee receives annual fees of $3,750 and $2,500, respectively.

The Board of Directors, based upon the recommendation of the Compensation Committee, may review and determine the form and amount of directors’ compensation, including cash, equity-based awards and other director compensation to maintain a transparent and readily understandable director compensation which ensures that the directors continue to receive fair and appropriate compensation for the time commitment required to discharge their duties for a company of our size.

15

The following table sets forth the compensation awarded to, earned by or paid to all persons who served as members of our Board of Directors other than our Named Executive Officers (as defined on page 17 hereof) during the year ended December 31, 2023. No director who is also a Named Executive Officer received any compensation for services as a director in 2023.

Name |

Fees

earned or |

Stock

Awards |

All

other |

Total |

| Emanuel Pearlman | $50,000 | $33,750 | $1,125 | $84,875 |

| Niv Harizman | $46,250 | $33,750 | $1,125 | $81,125 |

| Allison Hoffman | $48,750 | $33,750 | $1,125 | $83,625 |

___________________________

| (1) | Represents director’s fees payable in cash to each non-management director of $10,000 per quarter (or $40,000 per annum) for 2023 plus additional cash fees for serving on Board committees as disclosed above. |

| (2) | The amounts included in this column represent the grant date fair value of restricted stock unit awards (RSUs) granted to directors, computed in accordance with FASB ASC Topic 718. For a discussion of valuation assumptions see Note B[10] to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2023. The 15,000 RSUs granted to each non-management director vested on a quarterly basis beginning March 15, 2023. Each RSU represents the contingent right to receive one share of our common stock. |

| (3) | As of December 31, 2023, no stock options, RSUs or other awards were owned by any of the above referenced directors. |

| (4) | Includes dividends (dividend equivalent rights) earned upon vesting of RSUs for 2023. |

EXECUTIVE OFFICERS

All officers serve at the direction of our Board of Directors. The Board elects our officers.

Our executive officers are Corey M. Horowitz, our Chairman and Chief Executive Officer, Robert Mahan, our Chief Financial Officer, and Jonathan Greene, our Executive Vice President and Secretary. See backgrounds of Mr. Horowitz and Mr. Greene on page 9 of this Proxy Statement.

Robert M. Mahan became our Chief Financial Officer in December 2022. Mr. Mahan currently serves as President of Management and Financial Services, Inc., a consulting firm that he founded in 2011 which provides general management, financial and operations consulting services to public and private companies. In March 2023, he also became and continues to serve as Chief Financial Officer of Back Office Staffing Solutions, LLC, a private company providing back office processing services for staffing firms. From May 2021 to February 2022, Mr. Mahan served as Interim Chief Financial Officer of Loft Orbital Solutions, Inc., a space infrastructure company that designs, launches and operates low earth orbit satellites. From April 2019 to May 2021, he served as the Interim Chief Financial Officer of XWELL, Inc., formerly XpresSpa Group, Inc., (NASDAQ: XWEL),a global health and wellness holding company operating XpresCheck®, XpresSpa®, and Treat™ locations in airports. From November 2016 through April 2019, Mr. Mahan served as the Chief Financial Officer of SkyBell Technologies, Inc., a company engaged in the video doorbell and smart home industry. Mr. Mahan began his career in the audit practice of PricewaterhouseCoopers from 1989 through 1992 and as a Controller/Division Chief Financial Officer of Tommy Hilfiger USA, Inc. from 1992 – 2001.

| 16 |

EXECUTIVE COMPENSATION

Named Executive Officers

For the year ended December 31, 2023, we have determined that (i) our Chief Executive Officer, and (ii) our most highly compensated executive officers other than our Chief Executive Officer who served in such capacity during 2023 and at the end of 2023 whose total compensation exceeded $100,000, are our named executive officers (“ Named Executive Officers”), as follows:

Corey M. Horowitz, Chairman and Chief Executive Officer;

Robert Mahan, Chief Financial Officer; and

Jonathan Greene, Executive Vice President.

Compensation Overview

Network-1 Technologies, Inc. is a “smaller reporting company” under the rules promulgated by the Securities and Exchange Commission and the Company complies with the disclosure requirements applicable to smaller reporting companies. Accordingly, this executive compensation summary is not intended to meet the “Compensation Disclosure and Analysis” disclosure required of larger reporting companies.

Role of the Compensation Committee. All compensation for our Named Executive Officers is determined by the Compensation Committee of our Board of Directors which is composed only of independent directors. The Compensation Committee is responsible for reviewing the performance and establishing the total compensation of our Named Executive Officers on an annual basis. The Compensation Committee administers compensation plans for our Named Executive Officers and is responsible for recommending grants of equity awards under our stock incentive plan to the Board of Directors for approval. Our Chairman and Chief Executive Officer annually makes recommendations to the Compensation Committee regarding base salary, bonus compensation and equity awards for the other Named Executive Officers. Such recommendations are considered by the Compensation Committee; however, the Compensation Committee retains full discretion and authority over the final compensation decisions for our Named Executive Officers. The Compensation Committee has a formal written charter which is available on our website.

Advisory Vote on Executive Compensation. At our September 2023 annual meeting of stockholders, we held a stockholder advisory vote on the compensation of our Named Executive Officers, commonly referred to as a say-on-pay vote. Our stockholders approved the compensation of our Named Executive Officers at the September 2023 annual meeting, with a majority of stockholder votes cast in favor of our say-on-pay resolution. As we evaluated our compensation practices, we were mindful of the support our stockholders expressed for our compensation practices. As a result, following our annual review of our executive compensation, the Compensation Committee decided to retain our general approach to executive compensation. Our executive compensation for 2023 advances our retention goals and promotes both short-term and long-term performance of our executive officers and reflects our performance.

17

The following table summarizes compensation for the years ended December 31, 2023 and December 31, 2022, awarded to, earned by or paid to our Chief Executive Officer (“CEO”) and to each of our executive officers who received total compensation in excess of $100,000 for the year ended December 31, 2023 for services rendered in all capacities to us (collectively, the “Named Executive Officers”).

Summary Compensation Table

| Name

and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards($)(3) | All

Other Compensation($)(1) | Total($) | |||||||||||||||||

| Corey M. Horowitz | 2023 | $ | 545,572 | $ | 305,000 | (2) | $ | — | $ | 53,500 | (4) | $ | 904,072 | ||||||||||

| Chairman and Chief Executive Officer | 2022 | $ | 535,000 | $ | 175,000 | (2) | $ | 1,102,940 | $ | 109,675 | (4) | $ | 1,922,615 | ||||||||||

| Robert Mahan | 2023 | $ | 175,000 | $ | — | $ | 115,000 | (5) | $ | — | $ | 290,000 | |||||||||||

| Chief Financial Officer | |||||||||||||||||||||||

| Jonathan Greene | 2023 | $ | 200,000 | $ | 25,000 | $ | 33,900 | $ | 30,409 | (6) | $ | 289,309 | |||||||||||

| Executive Vice President | 2022 | $ | 200,000 | $ | 25,000 | $ | 41,100 | $ | 20,419 | (6) | $ | 286,519 | |||||||||||

| ______________________________________________ |

(1) We have concluded that the aggregate amount of perquisites and other personal benefits paid in 2023 and 2022 to either Mr. Horowitz, Mr. Mahan or Mr. Greene did not exceed $10,000.

(2) Mr. Horowitz received the following cash incentive bonus payments for 2023: (i) an annual discretionary bonus of $175,000 and (ii) incentive bonus compensation of $130,000 pursuant to his employment agreement (see “Employment Agreements – Termination of Employment Agreement and Change in Control Arrangements” below). Mr. Horowitz received for 2022 an annual discretionary bonus of $175,000.

(3) The amounts in this column represent the aggregate grant date fair value of restricted stock unit awards granted to the Named Executive Officers computed in accordance with FASB ASC Topic 718. In accordance with SEC rules, the grant date fair value of an award that is subject to a performance condition is based on the probable outcome of the performance condition. See Note B[10] to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2023 for a discussion of the assumptions made by the Company in determining the grant date fair value.

(4) Includes 401(k) matching funds contributions by the Company and profit sharing under the Company's 401(k) Plan for the benefit of Mr. Horowitz of $ 43,500 for 2023 and $40,500 for 2022, respectively. Also includes dividends (dividend equivalent rights) earned or paid upon vesting of restricted stock units owned by Mr. Horowitz in 2023 of $10,000 and $69,175 in 2022.

(5) Mr. Mahan became Chief Financial Officer of the Company on December 21, 2022.

(6) Includes 401(k) matching funds contributions by the Company and profit sharing under the Company's 401(k) Plan for the benefit of Mr. Greene of $29,659 for 2023 and $20,419 for 2022. Also includes dividend (dividend equivalent rights) earned upon vesting of restricted stock units owned by Mr. Greene in 2023 of $750.

| 18 |

Narrative Disclosure to Summary Compensation Table

Employment Agreements, Termination of Employment and Change-In-Control Arrangements

On March 22, 2022, we entered into a new employment agreement (“Agreement”) with Corey M. Horowitz, our Chairman and Chief Executive Officer, pursuant to which he continues to serve as our Chairman and Chief Executive Officer for a four year term (“Term”), at an annual base salary of $535,000 subject to increases of 3% per annum during the Term. The Agreement established an annual target bonus of $175,000 for our Chairman and Chief Executive Officer based upon performance. For the year ended December 31, 2023 and 2022, our Chairman and Chief Executive Officer received an annual discretionary bonus of $175,000.

In addition, pursuant to the Agreement, we granted to our Chairman and Chief Executive Officer, under our 2013 Plan, 600,000 restricted stock units (the “RSUs”, each RSU awarded by us to our officers, directors and consultants represents a contingent right to receive one share of our common stock) which terms provided for vesting in four tranches, as follows: (1) 175,000 RSUs which vested 100,000 RSUs on March 22, 2023 and 75,000 RSUs on March 22,2024, subject to Mr. Horowitz’s continued employment by us through each such vesting date (the “Employment Condition”) (“Tranche 1”); (2) 150,000 RSUs shall vest if at any time during the Term our common stock achieves a closing price for twenty (20) consecutive trading days (“Closing Price”) of a minimum of $3.50 per share (subject to adjustment for stock splits) and the Employment Condition is satisfied through the date such minimum per share Closing Price is achieved (“Tranche 2”); (3) 150,000 RSUs shall vest if at any time during the Term our common stock achieves a Closing Price of a minimum of $4.00 per share (subject to adjustment for stock splits) and the Employment Condition is satisfied through the date such minimum per share Closing Price is achieved (“Tranche 3”); and (4) 125,000 RSUs shall vest if at any time during the Term, our common stock achieves a Closing Price of a minimum of $4.50 per share (subject to adjustment for stock splits) and the Employment Condition is satisfied through the date such minimum per share Closing Price is achieved (“Tranche 4”). In the event of a Change of Control (as defined), Termination Other Than for Cause (as defined) or a termination by Mr. Horowitz for Good Reason (as defined) in each case prior to the last day of the Term, the vesting of all RSUs (Tranches 2, 3 and 4) shall accelerate (and not be subject to any conditions) and all RSUs shall become immediately fully vested. All RSUs granted by us to our officers, directors or consultants have dividend equivalent rights.

Under the terms of the Agreement, so long as Mr. Horowitz continues to serve as an executive officer of the Company, whether pursuant to the Agreement or otherwise, Mr. Horowitz shall also receive incentive compensation in an amount equal to 5% of our gross royalties or other payments from Licensing Activities (as defined) (without deduction of legal fees or any other expenses) with respect to our Remote Power Patent and a 10% net interest (gross royalties and other payments after deduction of all legal fees and litigation expenses related to licensing, enforcement and sale activities, but in no event shall he receive less than 6.25% of the gross recovery) of our royalties and other payments relating to Licensing Activities with respect to patents other than our Remote Power Patent (including all of our existing patent portfolios and our investment in ILiAD) (collectively, the “Incentive Compensation”). During the year ended December 31, 2023 and December 31, 2022, Mr. Horowitz earned Incentive Compensation of $130,000 and $-0-, respectively.

19

The Incentive Compensation shall continue to be paid to Mr. Horowitz for the life of each of our patents with respect to licenses entered into with third parties during the Term or at any time thereafter, whether he is employed by us or not; provided, that, the employment of Mr. Horowitz has not been terminated by us “For Cause” (as defined) or terminated by him without “Good Reason” (as defined). In the event of a merger or sale of substantially all of our assets, we have the option to extinguish the right of Mr. Horowitz to receive future Incentive Compensation by payment to him of a lump sum payment, in an amount equal to the fair market value of such future interest as determined by an independent third party expert if the parties do not reach agreement as to such value. In the event that Mr. Horowitz’s employment is terminated by us “Other Than For Cause” (as defined) or by him for “Good Reason” (as defined), Mr. Horowitz shall also be entitled to (i) a lump sum severance payment of 12 months base salary, (ii) a pro-rated portion of the $175,000 target bonus provided bonus criteria have been satisfied on a pro-rated basis through the calendar quarter in which the termination occurs and (iii) accelerated vesting of all unvested options, RSUs or other awards.

In connection with the Agreement, Mr. Horowitz has also agreed not to compete with us as follows: (i) during the Term and for a period of 12 months thereafter if his employment is terminated “Other Than For Cause” (as defined) provided he is paid his 12 month base salary severance amount and (ii) for a period of two years from the termination date, if terminated “For Cause” by us or “Without Good Reason” by Mr. Horowitz.

Jonathan Greene serves as our Executive Vice President and Secretary on an at-will basis at an annual base salary of $200,000. Mr. Greene received a discretionary annual bonus of $25,000 for each of 2023 and 2022. On January 8, 2024, Mr. Greene was granted 15,000 RSUs under the 2022 Plan, 50% of such RSUs will vest on the one year anniversary of the date of grant (January 8, 2025) and 50% of such RSUs will vest on the two year anniversary of the grant (January 8, 2026). On January 24, 2023, Mr. Greene was granted 15,000 RSUs under the 2022 Plan, 50% of such RSUs vested on the one year anniversary of the date of grant (January 24, 2024) and 50% of such RSUs will vest on the two year anniversary of the grant (January 24, 2025), subject to Mr. Greene’s continued employment.

Robert Mahan serves as our Chief Financial Officer since December 21, 2022 on a consulting basis at an annual compensation of $175,000. On September 8, 2023, Mr. Mahan was granted 50,000 RSUs under the 2022 Plan, 50% of such RSUs vest on the one year anniversary of the grant (September 8, 2024) and 50% of the RSUs vest on the two year anniversary date of grant (September 8, 2025), subject to Mr. Mahan’s continued service as Chief Financial Officer.

Profit Sharing 401(k) Plan

We offer all employees who have completed a year of service (as defined) participation in a 401(k) retirement savings plan, which provides a tax-advantaged method of saving for retirement. We expensed matching contributions and profit sharing of $73,159 and $78,194 under the 401(k) plan for the years ended December 31, 2023 and 2022, respectively.

20

Clawback Policy

In 2023, we adopted a compensation recovery (clawback) policy that complies with new SEC and NYSE rules with respect to the recovery of incentive compensation which allows us to recover excess compensation received by our executive officers related to a material restatement of our financial statements.

OUTSTANDING EQUITY AWARDS AT YEAR-END

Outstanding Equity Awards at December 31, 2023

The following table sets forth information relating to outstanding equity awards consisting of unvested restricted stock units for each Named Executive Officer as of December 31, 2023 (there were no outstanding stock options):

Option Awards |

Stock Awards | |||||

Name |

Number

of Securities |

Option Exercise Price ($) |

Option Expiration Date |

Equity incentive plan awards: Number of unearned shares, units or other rights that have not vested |

Equity incentive plan awards: Market value of unearned shares, units or other rights that have not vested(1) ($) | |

|

Exercisable |

Unexercisable | |||||

Corey M. Horowitz Chairman and CEO

|

—

|

—

|

—

|

—

|

500,000(2) | $1,090,000 |

Robert M. Mahan Chief Financial Officer

|

—

|

—

|

—

|

—

|

50,000(3) | $ 109,000 |

Jonathan Greene Executive Vice President |

—

|

— | —

|

—

|

22,500(4) | $ 49,050 |

_________________________________

| (1) | In accordance with SEC rules, market value is based on $2.18 per share representing the closing price of our common stock on the last trading day of the year. |

| (2) | Represents 500,000 unvested restricted stock units, the terms of the vesting of such restricted stock units are disclosed on page 19 under “Employment Agreements - Termination of Employment and Change-In-Control Arrangements.” |

| (3) | Represents 50,000 unvested restricted stock units, of which 25,000 restricted stock units vest on September 8, 2024 and 25,000 restricted stock units vest on September 8, 2025, subject to Mr. Mahan’s continued service as Chief Financial Officer. |

| (4) | Represents 22,500 unvested restricted stock units, of which (i) 7,500 restricted stock units vested on January 18, 2024, (ii) 7,500 restricted stock units vested on January 24, 2024, and (iii) 7,500 restricted stock units will vest on January 24, 2025, subject to Mr. Greene’s continued employment. |

21

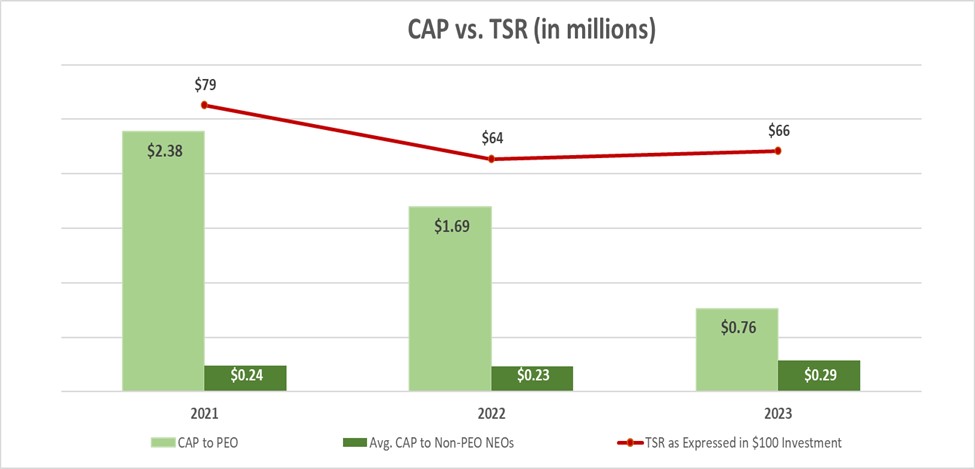

Pay Versus Performance

As required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 402(v) of Regulation S-K, we are providing the following information about the relationship between executive compensation and certain financial performance of our Company. The disclosure included in this section is prescribed by SEC rules and does not necessarily align with how the Company or its Compensation Committee view the link between the Company’s performance and the pay of its Named Executive Officers (“NEOs”).

The table below presents information on the compensation of our principal executive officer (“PEO”) and our Non-PEO NEOs in comparison to certain performance metrics for 2023, 2022 and 2021. The metrics are not those that our Compensation Committee uses when setting executive compensation. The use of the term “compensation actually paid” (“CAP”) is required by the SEC’s rules. Neither CAP nor the total amount reported in the Summary Compensation Table (“SCT”) reflect the amount of compensation actually paid, earned or received during the applicable year. Per SEC rules, CAP was calculated by adjusting the SCT Total values for the applicable year as described in the footnotes to the table.

Year | Summary Compensation Table Total for PEO(2) | Compensation Actually Paid to PEO (3) | Average Summary Compensation Table Total for Non-PEO Named Executive Officers (2) | Average Compensation Actually Paid to Non-PEO Named Executive Officers (3) | Value of Initial Fixed $100 Investment Based on Total Shareholder Return (4) | Net Income (Loss) | |||||||||||||||||||

2023 (1) | $ | 904,072 | $ | 764,228 | $ | 289,655 | $ | 285,867 | $ | 66 | $ | (1,457,000) | |||||||||||||

| 2022 (1) | $ | 1,922,615 | $ | 1,692,636 | $ | 239,401 | $ | 232,638 | $ | 64 | $ | (2,326,000) | |||||||||||||

| 2021 (1) | $ | 2,549,500 | $ | 2,384,500 | $ | 251,456 | $ | 241,518 | $ | 79 | $ | 14,281,000 | |||||||||||||

_________________________________

| (1) | For 2023, the PEO was Corey M. Horowitz and the NEOs were Jonathan Greene and Robert Mahan. For 2022 and 2021 the PEO was Corey M. Horowitz and the NEOs were Jonathan Greene and David C. Kahn. |

| (2) | Amounts in this column represent the “Total” column set forth in the SCT on page 18 hereof. See the footnotes to the SCT for further detail regarding the amounts in these columns. |

| (3) | The dollar amounts reported in these columns represent the amounts of “compensation actually paid”. The amounts are computed in accordance with Item 402(v) of Regulation S-K by deducting and adding the following amounts from the “Total” column of the SCT (pursuant to SEC rules, fair value at each measurement date is computed in a manner consistent with the fair value methodology used to account for share-based payments in our financial statements under GAAP): |

22

Adjustments Made to Determine Compensation “Actually Paid” for PEO Named Executive Officer:

| 2023 | 2022 | 2021 | ||||||||||

Deduction for amounts reported under “Stock Awards” column in the SCT | $ | ‒‒ | $ | (1,102,940 | ) | $ | ‒‒ | |||||

Increase for year end fair value of awards granted during year that remain unvested as of year end | $ | ‒‒ | $ | 872,961 | $ | ‒‒ | ||||||

Change in fair value of awards granted in prior years that remain unvested as of year end | $ | (131,792 | ) | $ | ‒‒ | $ | ‒‒ | |||||

| Change in fair value of awards granted in prior years that vested during the year | $ | (8,053 | ) | $ | ‒‒ | $ | (165,000 | ) | ||||

| Total Adjustments | $ | (139,845 | ) | $ | (229,979 | ) | $ | (165,000 | ) | |||

Adjustments Made to Determine Average Compensation “Actually Paid” for Non-PEO Named Executive Officers

| 2023 | 2022 | 2021 | ||||||||||

Deduction for average amounts reported under “Stock Awards” column in the SCT | $ | (74,450 | ) | $ | (20,500 | ) | $ | ‒‒ | ||||

Average increase for year end fair value of awards granted during the year that remain unvested as of year end | $ | 70,850 | $ | 16,500 | $ | ‒‒ | ||||||

Average change in fair value of awards granted in prior years that vested during year | $ | (113 | ) | $ | (2,713 | ) | $ | (6,131 | ) | |||

Average change in fair value of awards granted in prior years that remain unvested as of year end | $ | (75 | ) | $ | ‒‒ | $ | (3,806 | ) | ||||

| Total Adjustments | $ | (3,788 | ) | $ | (6,763 | ) | $ | (9,938 | ) | |||

| (4) | Total shareholder return assumes that $100 was invested on December 31, 2020 in our Company and that dividends were reinvested when and as paid. |

23

Graphical

Representation of Compensation Actually Paid

(CAP) and Performance

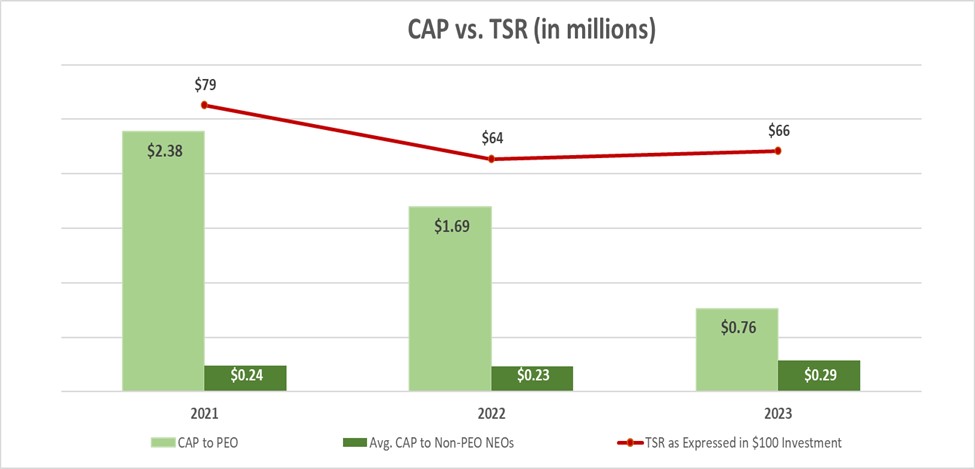

The following graph illustrates the relationship of the CAP for our PEO and other NEOs, as calculated pursuant to SEC rules, to our TSR over the three years presented in the Pay Versus Performance Table.

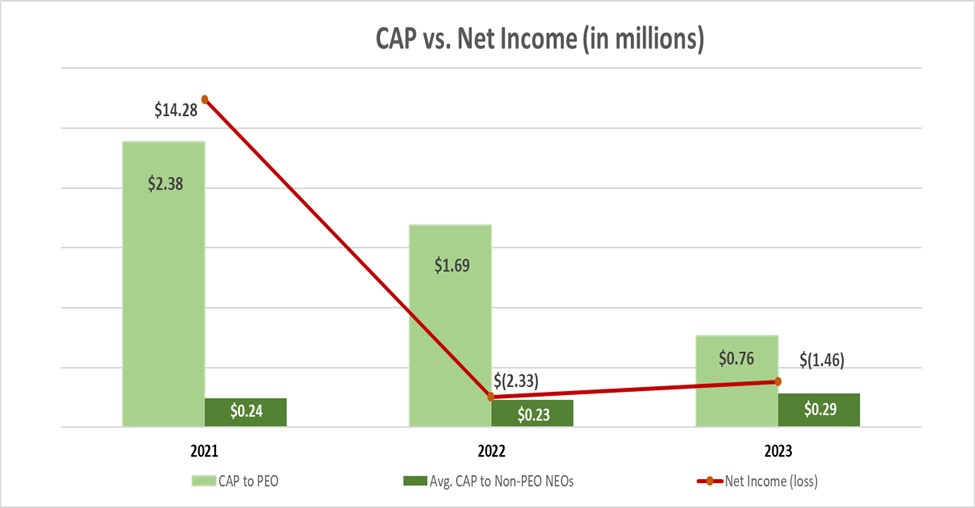

The following graph illustrates the relationship of the CAP for our PEO and other NEOs, as calculated pursuant to SEC rules, to our net income (loss) over the three years presented in the Pay Versus Performance Table.

| 24 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth information regarding the beneficial ownership of our common stock as of July 1, 2024 for (i) each of our directors, (ii) each of our executive officers, (iii) each person known by us to be the beneficial owner of more than 5% of our outstanding shares of common stock, and (iv) all of our executive officers and directors as a group.

NAME AND ADDRESS OF BENEFICIAL OWNER |

AMOUNT AND NATURE OF BENEFICIAL |

PERCENTAGE | |

Executive Officers and Directors: Corey M. Horowitz(3) |

6,797,337 |

29.3% | |

| CMH Capital Management Corp.(4) | 2,291,372 | 9.9%

| |

| Niv Harizman(5) | 309,735 | 1.3% | |

| Emanuel Pearlman(6) | 135,809 | * | |

| Jonathan E. Greene(7) | 103,597 | * | |

| Allison Hoffman(8) | 98,061 | * | |

| Robert Mahan(9) | — | * | |

| All

officers and directors as a group (5 Persons) |

7,444,539 | 32.1% | |

| 5% Stockholders: | |||

| Steven D. Heinemann(10) | 1,941,696 | 8.4% | |

| Goose Hill Capital LLC(11) | 1,356,563 | 5.9% | |

| Clayton Partners LLC(12) | 1,435,200 | 6.2% |

_____________________________________

*Less than 1%.

| (1) | Unless otherwise indicated, we believe that all persons named in the above table have sole voting and investment power with respect to all shares of our common stock beneficially owned by them. Unless otherwise indicated the address for each listed beneficial owner is c/o Network-1 Technologies, Inc., 65 Locust Avenue, Third Floor, New Canaan, Connecticut 06840. |

| 25 |

| (2) | A person is deemed to be the beneficial owner of shares of common stock that can be acquired by such person within 60 days from July 1, 2024 upon the exercise of stock options, vesting of restricted stock units or the conversion of other convertible securities within such 60 day period. Each beneficial owner's percentage ownership is determined by assuming that all stock options, restricted stock units or other convertible securities held by such person (but not those held by any other person) and which are exercisable, convertible or vest within 60 days from July 1, 2024 have been exercised, converted or vested. Assumes a base of 23,190,110 shares of our common stock outstanding as of July 1, 2024. |

| (3) | Includes (i) 3,983,954 shares of common stock owned by Mr. Horowitz, (ii) 2,157,097 shares of common stock held by CMH Capital Management Corp., an entity solely owned by Mr. Horowitz, (iii) 134,275 shares of common stock owned by the CMH Capital Management Corp. Profit Sharing Plan, of which Mr. Horowitz is the trustee, (iv) 67,470 shares of common stock owned by Donna Slavitt, the wife of Mr. Horowitz, (vi) an aggregate of 452,250 shares of common stock held by two trusts and a custodian account for the benefit of Mr. Horowitz’s three children, and (vii) 2,291 shares of common stock held by Horowitz Partners, a general partnership of which Mr. Horowitz is a partner. Does not include 425,000 restricted stock units owned by Mr. Horowitz that do not vest within 60 days of July 1, 2024. |

| (4) | Includes 2,157,097 shares of common stock owned by CMH Capital Management Corp. and 134,275 shares of common stock owned by CMH Capital Management Corp. Profit Sharing Plan. Corey M. Horowitz, by virtue of being the sole officer, director and shareholder of CMH Capital Management Corp. and the trustee of the CMH Capital Management Corp. Profit Sharing Plan, has the sole power to vote and dispose of the shares of common stock owned by CMH Capital Management Corp. and the CMH Capital Management Corp. Profit Sharing Plan. |

| (5) | Includes 309,735 shares of common stock. Does not include 7,500 shares of common stock subject to restricted stock units owned by Mr. Harizman that do not vest within 60 days from July 1, 2024. |

| (6) | Includes 135,809 shares of common stock. Does not include 7,500 shares of common stock subject to restricted stock units owned by Mr. Pearlman that do not vest within 60 days from July 1, 2024. |

| (7) | Includes 103,597 shares of common stock. Does not include 22,500 shares of common stock subject to restricted stock units owned by Mr. Greene that do not vest within 60 days from July 1, 2024. |

| (8) | Includes 98,061 shares of common stock. Does not include 7,500 shares of common stock subject to restricted stock units owned by Ms. Hoffman that do not vest within 60 days from July 1, 2024. |

| (9) | Does not include 50,000 restricted stock units owned by Mr. Mahan that do not vest within 60 days from July 1, 2024. |

| 26 |