UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

14A

(RULE 14a-101)

INFORMATION

REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ______)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Network-1 Technologies, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identity the filing for which the offsetting fee was paid previously. Identity the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date

Filed: | |

Network-1 Technologies, Inc.

65 Locust Avenue, Third Floor

New Canaan, Connecticut 06840

August 5, 2022

Dear Network-1 Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders of Network-1 Technologies, Inc. (the “Company”) which will be held on Tuesday, September 20, 2022, at 10:00 A.M. (Eastern Time), virtually, via a live audio webcast at https://web.lumiagm.com/201466103. The Annual Meeting will be a completely virtual meeting of stockholders which will be conducted exclusively by webcast on the Internet. The Annual Meeting is being held entirely online due to the ongoing public health impact of the coronavirus pandemic (COVID-19) and to support the health and well being of our directors and stockholders. No physical meeting will be held. You will be able to attend the meeting, vote and submit your questions at such website during the meeting.

Details regarding the Annual Meeting and the business to be conducted are more fully described in the accompanying Notice of 2022 Annual Meeting of Stockholders and Proxy Statement.

Your vote is important. Whether or not you plan to attend the Annual Meeting, I hope you will vote as soon as possible. You may vote over the Internet or virtually at the Annual Meeting, or you also may vote by mailing a proxy card or by telephone. Please review the instructions on the proxy card regarding your voting options.

Cordially,

/s/ Corey M. Horowitz

Corey M. Horowitz

Chairman and Chief Executive Officer

YOUR VOTE IS IMPORTANT In order to ensure your representation at the Annual Meeting, whether or not you plan to attend the meeting, please vote your shares as promptly as possible over the Internet or by telephone by following the instructions on your proxy card. Your participation will help to ensure the presence of a quorum at the Annual Meeting and save the Company the extra expense associated with additional solicitation. If you hold your shares through a broker, bank or other nominee, your broker, bank or other nominee is not permitted to vote on your behalf in the election of directors (Proposal 1), approval of the 2022 Stock Incentive Plan (Proposal 2) or the non-binding advisory Say on Pay Vote (Proposal 3) unless you provide specific instructions to your broker, bank or other nominee by completing and returning any voting instruction form that your broker, bank or other nominee provides or following instructions that allow you to vote your broker-held shares via telephone or the Internet. Voting your shares in advance will not prevent you from attending the Annual Meeting, revoking your earlier submitted proxy or voting your shares virtually during the Annual Meeting. |

NETWORK-1 TECHNOLOGIES, INC.

65 Locust Avenue, Third Floor

New Canaan, Connecticut 06840

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 20, 2022

To the Stockholders of Network-1 Technologies, Inc.:

NOTICE IS HEREBY GIVEN that the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of Network-1 Technologies, Inc. (the “Company”) will be held on Tuesday, September 20, 2022, at 10:00 A.M. (Eastern Time), virtually, via a live audio webcast on the Internet at https://web.lumiagm.com/201466103, for the following purposes.

| 1. | To elect five directors to serve until the next Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified (Proposal 1); |

| 2. | To approve the Network-1 Technologies, Inc. 2022 Stock Incentive Plan (Proposal 2); |

| 3. | To cast a non-binding, advisory vote to approve the compensation of our named executive officers (“Say on Pay Vote”) (Proposal 3); |

| 4. | To ratify the appointment of Friedman LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022 (Proposal 4); and |

| 5. | To transact such other business as may properly come before the Annual Meeting (including any adjournments or postponements thereof). |

The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively by webcast on the Internet. No physical meeting will be held. Only stockholders of record at the close of business on July 26, 2022 are entitled to receive the notice of and to vote at the Annual Meeting or any postponement or adjournment thereof.

If your shares are registered in your name with American Stock Transfer & Trust Company LLC (“AST”), the Company’s transfer agent, and you wish to attend the online-only virtual meeting, go to https://web.lumiagm.com/201466103, enter the 11 digit voter control number you received on your proxy card or proxy materials and the password for the Annual Meeting, which is network2022. We encourage you to use ample time for online check-in which will begin at 9:00 A.M. (Eastern Time) on the day of the Annual Meeting.

If your shares are registered in the name of your broker, bank or other nominee, you are a “beneficial owner” of the shares. Beneficial owners of shares who wish to attend the online-only virtual meeting must obtain a valid legal proxy by contacting your account representative at the bank, broker, or other nominee that holds your shares and then register in advance to virtually attend the Annual Meeting. After obtaining a valid legal proxy from your broker, bank or other nominee, to then register to virtually attend the Annual Meeting, you must submit a copy of your legal proxy reflecting the number of your shares along with your name and e-mail address to American Stock Transfer and Trust Company, LLC. Request for registration should be directed to proxy@astfinancial.com or to facsimile number 718-765-8730. Written requests can be mailed to: American stock Transfer & Trust LLC, Attn: Proxy Tabulation Department, 6201 15th Avenue, Brooklyn, New York 11219. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00p.m. (Eastern Time) on September 13, 2022.

Your Board of Directors believes that the election of the nominees specified in the accompanying Proxy Statement as directors at the Annual Meeting is in the best interest of the Company and its stockholders and, accordingly, unanimously recommends a vote “FOR” such nominees. The Board of Directors also recommends that you vote “FOR” the approval of the 2022 Stock Incentive Plan, “FOR” the Say on Pay Vote and “FOR” ratifying the appointment of Friedman LLP as the Company’s independent registered public accounting firm.

By Order of the Board of Directors,

|

|

| August 5, 2022 | /s/ Corey M. Horowitz |

| Corey M. Horowitz | |

| Chairman, Chief Executive Officer

and Chairman of the Board of Directors |

TABLE OF CONTENTS

| GENERAL INFORMATION | 1 |

| Record Date | 1 |

| Quorum | 1 |

| Shares Outstanding | 2 |

| Shareholders of Record/Beneficial Owners | 2 |

| Voting | 2 |

| Revoking Your Proxy | 3 |

| Votes Required to Adopt Proposals and Abstentions and Broker Non-Votes | 4 |

| Effect of Not Casting Your Vote | 5 |

| Effect of Abstentions and Broker Non-Votes | 5 |

| Voting Instructions | 6 |

| Tabulating the Vote | 6 |

| Voting Results | 6 |

| Solicitation/Costs | 6 |

| Virtual Annual Meeting | 7 |

| Submitting a Question | 7 |

| Technical Difficulties | 7 |

| PROPOSAL 1 - ELECTION OF DIRECTORS | 8 |

| CORPORATE GOVERNANCE | 11 |

| Director Independence | 11 |

| Board Leadership Structure | 11 |

| Board Oversight of Risk | 11 |

| Meetings of the Board of Directors and Board Committees | 11 |

| Board Committees | 11 |

| Anti-Hedging and Anti-Pledging Policies | 13 |

| Code of Ethics | 13 |

| Communications with the Board | 13 |

| CONSIDERATION OF DIRECTOR NOMINEES | 13 |

| DEADLINE AND PROCEDURES FOR SUBMITTING BOARD NOMINATIONS | 14 |

| COMPENSATION OF DIRECTORS | 15 |

| EXECUTIVE OFFICERS | 16 |

| EXECUTIVE COMPENSATION | 16 |

| Named Executive Officers | 16 |

| Compensation Overview | 16 |

| Summary Compensation Table | 17 |

| Narrative Disclosure to Summary Compensation Table | 18 |

| Outstanding Equity Awards At Year-End | 20 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 21 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 23 |

| AUDIT COMMITTEE REPORT | 23 |

| PROPOSAL 2 - APPROVAL OF THE NETWORK-1 TECHNOLOGIES, INC. 2022 STOCK INCENTIVE PLAN | 24 |

| Proposal | 24 |

| Summary of Material Features of the Plan | 25 |

| Rationale for Adoption of the 2022 | 26 |

| Summary of the Plan | 26 |

| New Plan Benefits | 30 |

| Tax Aspects Under the Code | 30 |

| Equity Compensation Plan Information | 32 |

| PROPOSAL 3 - NON-BINDING ADVISORY VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICER COMPENSATION | 33 |

| PROPOSAL 4 - RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 34 |

| Audit Fees | 34 |

| Audit Related Fees, Tax Fees and All Other Fees | 34 |

| Audit Committee Pre-Approval Policies and Procedures | 34 |

| STOCKHOLDER PROPOSALS FOR 2023 ANNUAL MEETING | 35 |

| OTHER INFORMATION | 36 |

NETWORK-1 TECHNOLOGIES, INC.

PROXY STATEMENT

FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD TUESDAY, SEPTEMBER 20, 2022

GENERAL INFORMATION

Our Board of Directors (the “Board”) solicits your proxy on our behalf for the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of Network-1 Technologies, Inc. and at any postponement or adjournment of the Annual Meeting for the purposes set forth in this Proxy Statement and the accompanying Notice of 2022 Annual Meeting of Stockholders (the “Notice”). The Annual Meeting will be held at 10:00 A.M. (Eastern Time) on Tuesday, September 20, 2022, virtually, via live audio webcast on the Internet at https://web.lumiagm.com/201466103. The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively by webcast on the Internet. The Annual Meeting is being held entirely online due to the ongoing public health impact of the coronavirus pandemic (COVID-19) and to support the health and well being of our directors and stockholders. No physical meeting will be held. You will be able to attend the Annual Meeting, vote and submit your questions at such website during the meeting.

In this Proxy Statement the terms “Network-1”, the “Company”, “we”, “us”, and “our” refer to Network-1 Technologies, Inc. The address and telephone number of our principal executive offices is Network-1 Technologies, Inc., 65 Locust Avenue, Third Floor, New Canaan, Connecticut 06840, telephone: (203) 920-1055. This Proxy Statement, the accompanying proxy card and our 2022 Annual Report will be first sent on or about August 5, 2022 to all stockholders of record as of July 26, 2022.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON SEPTEMBER 20, 2022: This Proxy Statement and the Company’s 2021 Annual Report are available for review on the Internet at http://www.network-1.com/sec/proxy2022/.

| Record Date | July 26, 2022; only stockholders of record of the Company’s common stock at the close of business on July 26, 2022 (the “Record Date”) are entitled to receive notice of and to vote at the Annual Meeting. |

| Quorum | A majority of the shares of all issued and outstanding stock entitled to vote on the Record Date must be present in person at the Annual Meeting or represented by proxy to constitute a quorum. Votes withheld from any nominee, abstentions and “broker non-votes” (i.e., where a broker has not received voting instructions from the beneficial owner and for which the broker does not have discretionary power to vote on a particular matter) are counted as present for purposes of determining the presence of a quorum.

|

| 1

|

| Shares Outstanding | As of July 26, 2022 (Record Date) there were 23,791,194 shares of Network-1’s common stock issued and outstanding. |

| Shareholders of Record/ Beneficial Owners | If your shares are registered directly in your name with American Stock Transfer & Trust Company, LLC, the Company’s transfer agent, you are a shareholder of record with respect to those shares. If your shares are held in an account at a brokerage firm, bank or other nominee, then you are the beneficial owner of shares held in “street name”. As a beneficial owner, you have the right to instruct your brokerage firm, bank or other nominee how to vote your shares. Most individual shareholders are beneficial owners of shares held in “street name”. |

| Voting | Each share of Network-1 common stock has one vote on each matter. Only shareholders of record as of the close of business on the Record Date (July 26, 2022) are entitled to vote at the Annual Meeting. There are four ways a stockholder of record can vote: |

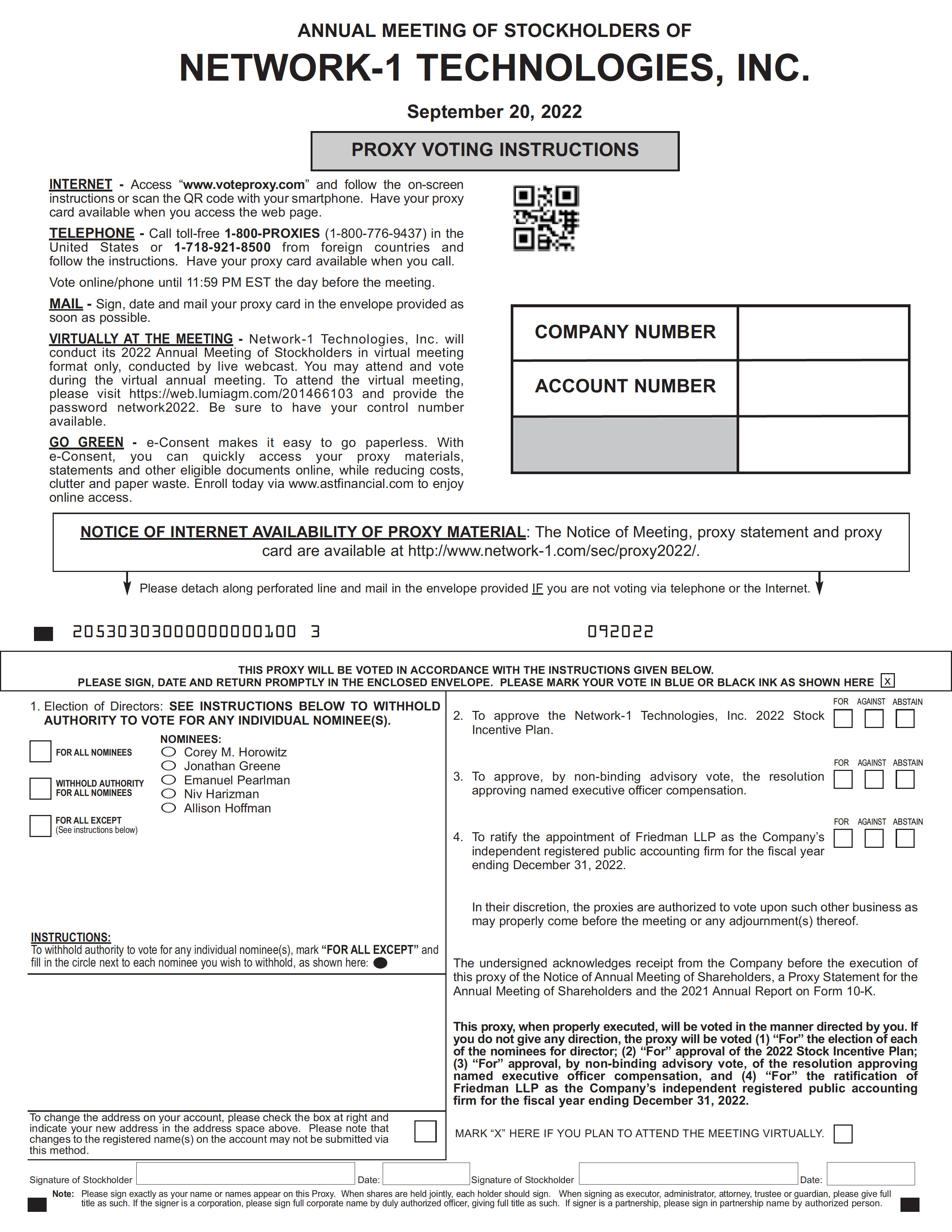

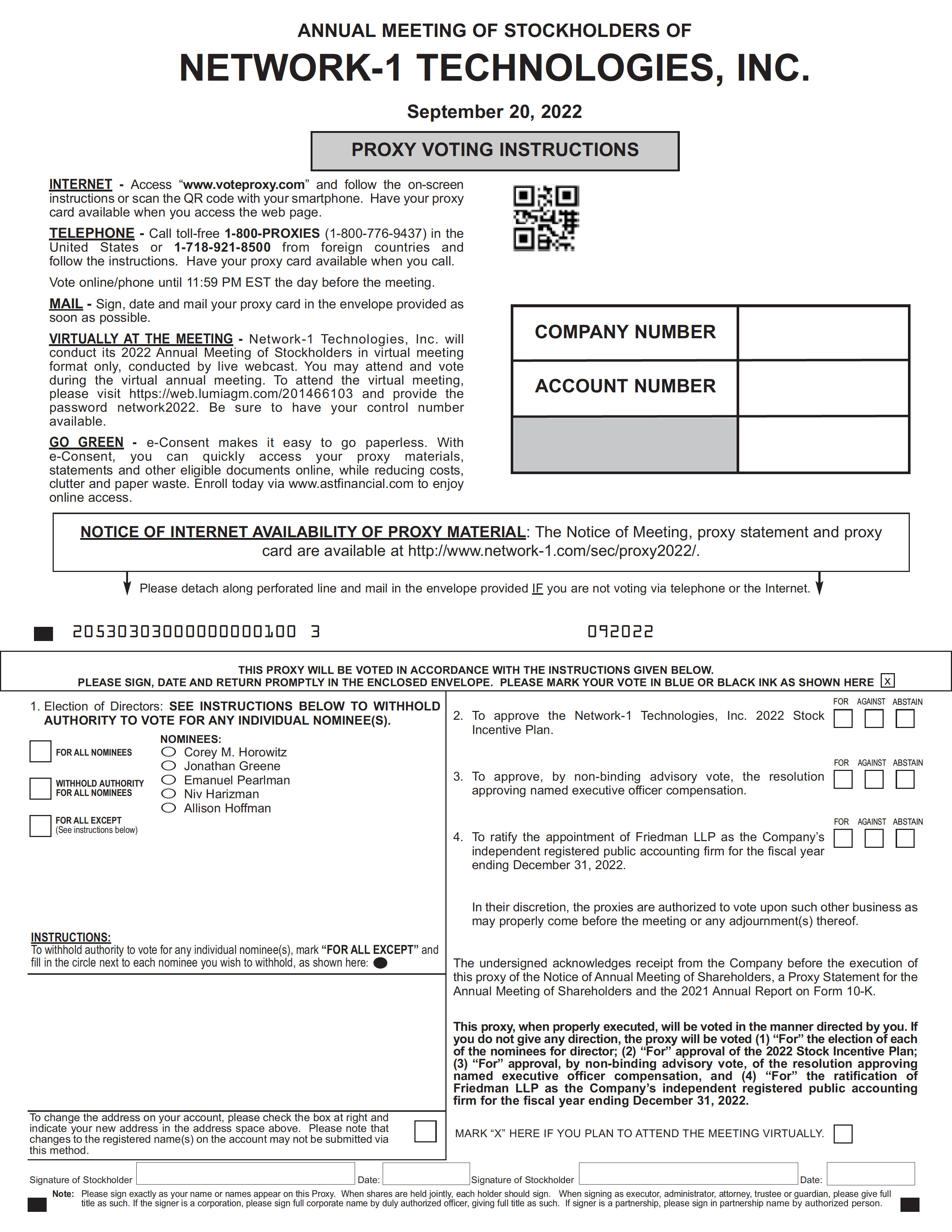

| (1) By Internet: you may vote over the Internet by following the instructions provided on the proxy card; | |

| (2) By Telephone: you may vote by telephone by following the instructions on the proxy card; | |

| (3) By Mail: you may complete, sign and return the accompanying proxy card, in the postage-paid envelope provided; and | |

| (4) Virtually: if you are a stockholder of record as of the Record Date, you may vote virtually at the meeting at https://web.lumiagm.com/(password: network2022). You will need the 11 digit voter control number included on your proxy card and the meeting password: network2022. Submitting a proxy will not prevent a stockholder from attending the Annual Meeting, revoking their earlier submitted proxy, and voting virtually. |

| 2 |

If you hold your shares as a beneficial owner (in street name) through a broker, bank or other nominee, you must first obtain a valid legal proxy from your bank, broker, or other nominee and then register in advance to attend the Annual Meeting. Follow the instructions from your bank, broker, or other nominee included with these proxy materials, or contact your bank, broker, or other nominee to request a legal proxy form. After obtaining a valid legal proxy from your bank, broker, or other nominee to then register to attend the Annual Meeting, you must submit proof of your legal proxy reflecting the number of your shares along with your name and email address to American Stock Transfer & Trust Company, LLC (“AST”). Requests for registration should be directed to proxy@astfinancial.com or to facsimile number 718-765-8730. Written requests can be mailed to: American

Stock Transfer & Trust Company, LLC Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 P.M. (Eastern Time), on Tuesday, September 13, 2022. Even if you plan to attend the virtual Annual Meeting, we recommend that you vote your shares in advance as described above so that your vote will be counted if you later decide not to attend the Annual Meeting. | |

| Revoking Your Proxy | Stockholders of record may revoke their proxies at any time before the voting is closed at the Annual Meeting. You may revoke your proxy by attending the Annual Meeting and voting virtually, by filing an instrument in writing revoking your proxy or by filing another duly executed proxy bearing a later date with our Secretary before the vote is closed at the Annual Meeting, or by voting again using the telephone or Internet before the cutoff time (your latest telephone or Internet proxy is the one that will be counted). If you hold shares through a bank, broker or other nominee, you may revoke any prior instructions by contacting that organization. |

| 3 |

| Votes Required to Adopt Proposals and Abstentions and Broker Non-Votes | The table below summarizes the votes required for approval of each matter to be brought before the Annual Meeting, as well as the treatment of abstentions and broker non-votes. If you sign and return a proxy but do not specify how you want your shares voted, your shares will be voted FOR the director nominees and FOR the other proposals listed below: |

| Proposal | Vote

Required for Approval of Each Item |

Abstentions or Withheld Votes (for Election of Directors) | Broker Non-Votes |

| (1) Election of Directors | Each director shall be elected by a plurality of the votes (greatest number of votes FOR) of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors (Proposal 1). | No effect on this proposal | No effect on this proposal |

| (2) Approval of the 2022 Stock Incentive Plan | The affirmative vote of a majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote on Proposal 2 is required to approve this proposal. | Counted as “against” | No effect on this proposal |

| (3) Advisory Vote on Say on Pay Vote | The affirmative vote of a majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote on Proposal 3 is required to approve this proposal. | Counted as “against” | No effect on this proposal |

| (4) Ratification of Appointment of Auditors | The affirmative vote of a majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote on Proposal 4 is required to approve this proposal. | Counted as “against” | Not applicable since brokerage firms or banks have discretionary authority to vote on this proposal |

| 4 |

| Effect of Not Casting Your Vote | If you are a beneficial owner and hold your shares in street name and want your shares to count in the election of directors (Proposal 1), approval of the 2022 Stock Incentive Plan (Proposal 2) or the Say on Pay Vote (Proposal 3), you will need to instruct your broker, bank or other nominee how you want your shares voted. If you hold your shares in street name and you do not instruct your brokerage firm, bank or other nominee how to vote in the election of directors (Proposal 1), approval of the 2022 Stock Incentive Plan (Proposal 2) or the Say on Pay Vote (Proposal 3), no vote will be cast on your behalf on any of these proposals for which you did not provide voting instructions. Your brokerage firm, bank or other nominee will only have the discretion to vote any uninstructed shares on the ratification of the appointment of the Company’s independent registered public accounting firm (Proposal 4). |

| If you are a shareholder of record and do not return your proxy or attend the Annual Meeting, your shares will not be considered present at the Annual Meeting for voting purposes or determining whether we have a quorum and no vote will be cast for your shares at the Annual Meeting. | |

| Effect of Abstentions and Broker Non-Votes | Under the rules that govern brokers holding shares for their customers, brokers who do not receive voting instructions from their customers have the discretion to vote uninstructed shares on routine matters, but do not have discretion to vote such uninstructed shares on non-routine matters. Only Proposal 4, the ratification of the appointment of Friedman LLP, is considered a routine matter where brokers are permitted to vote shares held by them without instruction. If your shares are held through a broker, those shares will not be voted on the election of directors (Proposal 1), approval of the 2022 Stock Incentive Plan (Proposal 2) or the Say on Pay Vote (Proposal 3) unless you affirmatively provide the broker with instructions on how to vote. |

| 5 |

| Voting Instructions | If you complete and submit your proxy voting instructions, the persons appointed by the Board as proxies (the persons named in the proxy card) will vote your shares as instructed. If you submit your proxy card but do not direct how your shares should be voted on each item, the persons named as proxies by the Board will vote FOR the election of the nominees for directors named in this proxy statement, FOR the approval of the 2022 Stock Incentive Plan, FOR the advisory Say on Pay Vote, and FOR the ratification of the appointment of Friedman LLP as our independent registered public accounting firm. With respect to the election of the nominees for director, proxies that direct the proxy holders appointed by the Board (the persons named in the proxy card) to withhold voting will not be voted. The persons named as proxies will vote on any other matters properly presented at the Annual Meeting, or any postponement or adjournment thereof, in accordance with their best judgment, although the Board is not aware of any other matters other than those set forth in the Proxy Statement that will be presented for voting at the Annual Meeting. |

| Tabulating the Vote | Votes will be counted and certified by one or more Inspectors of Election who are expected to be an employee of American Stock Transfer & Trust Company, LLC, the transfer agent for the Company’s common stock, and a representative of the legal counsel to the Company. |

| Voting Results | We will announce preliminary results at the Annual Meeting. We will report final results by filing a Form 8-K within four business days after the Annual Meeting. If final results are not available at that time, we will provide preliminary voting results in the Form 8-K and will provide the final results in an amendment to the Form 8-K as soon as they become available. |

| Solicitation/Costs | We are paying for the distribution of the proxy materials and solicitation of the proxies. As part of this process, we reimburse brokerage firms, banks and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to our stockholders. Proxy solicitation expenses that we will pay include those for preparation, mailing, returning and tabulating the proxies. Our directors, officers and employees may also solicit proxies on our behalf in person, by telephone, email or facsimile, but they do not receive additional compensation for providing those services. |

| 6 |

| Virtual Annual Meeting | The Annual Meeting is being held entirely online due to the ongoing public health impact of the coronavirus pandemic (COVID-19) and to support the health and well being of our directors and stockholders. Hosting a virtual annual meeting provides easy access for our stockholders and facilitates participation since stockholders can participate from any location. |

| You will be able to participate in the Annual Meeting of Stockholders online and submit your questions during the meeting by visiting https://web.lumiagm.com/201466103. To be admitted to the Annual Meeting, you must enter the 11 digit voter control number included in your proxy materials or on your proxy card and the password for the Annual Meeting, which is network2022. We encourage you to allow ample time for online check-in, which will begin at 9:00 a.m. Eastern Time on the day of the Annual Meeting. We recommend that you carefully review the procedures to gain admission virtually to the Annual Meeting in advance. You will also be able to vote your shares electronically prior to or during the Annual Meeting. | |

| Submitting a Question | If you want to submit a question during the Annual Meeting, log into https://web.lumiagm.com/201466103 (password: network2022). We intend to answer properly submitted questions that are pertinent to the Company and the meeting matters, as time permits. However, we reserve the right to edit inappropriate language to exclude questions that are not pertinent to meeting matters or that are otherwise inappropriate. The questions and answers will be available as soon as practicable after the Annual Meeting a http://www.network-1.com/sec/proxy2022/ and will remain available for one week after posting. |

| Technical Difficulties | If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting login page. |

| 7 |

PROPOSAL 1

ELECTION OF DIRECTORS

The Company’s Bylaws provide that at each annual meeting of stockholders, directors shall be elected to hold office until the expiration of the term for which they are elected, and until their respective successors are duly elected and qualified or until the director’s earlier resignation or removal. The Company’s Board of Directors has fixed the number of members of the Board of Directors at five members.

At the Annual Meeting, proxies granted by stockholders will be voted individually for the election, as directors of the Company, of the five persons listed below, unless a proxy specifies that it is not to be voted in favor of a nominee for director. In the event any of the nominees listed below is unable to serve (or for whatever reason declines to serve) at the time of the Annual Meeting, it is intended that the proxy will be voted for such other nominees as are designated by the Board of Directors. Each of the persons named below, who are presently members of the Company’s Board of Directors and the one nominee (Jonathan Greene) who is not presently on the Board, has indicated to the Board of Directors of the Company that he or she will be available to serve.

All nominees have been recommended by the Company’s Nominating and Corporate Governance Committee.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE ELECTION OF THE NOMINEES SPECIFIED BELOW.

The following table sets forth the name and age of the nominees for election at this Annual Meeting and the length of continuous service as a director of the Company. Also included in the table below is information each director has given us about all positions he or she holds, the director’s principal occupation and business experience for at least the past five years, and the names of other publicly-held companies of which he or she currently serves as a director or has served as a director during the past five years. In addition to the information presented below regarding each director’s specific experience, qualifications, attributes and skills that led our Board to the conclusion that he or she should serve as a director, we also believe that all of our directors have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to Network-1 and our Board.

| NAME | AGE | POSITION | DIRECTOR SINCE |

| Corey M. Horowitz | 67 | Chairman, Chief Executive Officer and Chairman of the Board of Directors | April 1994 |

| Jonathan Greene | 60 | Executive Vice President | — |

| Emanuel R. Pearlman | 62 | Director | January 2012 |

| Niv Harizman | 58 | Director | December 2012 |

| Allison Hoffman | 51 | Director | December 2012 |

| 8 |

Corey M. Horowitz has been our Chairman and Chief Executive Officer since December 2003. Mr. Horowitz has also served as Chairman of our Board of Directors since January 1996 and has been a member of our Board of Directors since April 1994. In December 2018, Mr. Horowitz became a member of the Board of Managers of ILiAD Biotechnologies, LLC, a privately held biotechnology company, in connection with our investment in the company. Mr. Horowitz is also a member of the Life Sciences Institute Leadership Council at the University of Michigan. We believe Mr. Horowitz’s qualifications to serve on our Board of Directors include his significant experience and expertise as an executive in the intellectual property field, his understanding of our intellectual property and the patent acquisition, licensing and enforcement business combined with his private equity and corporate transactional experience.

Jonathan Greene is a nominee for our Board of Directors. Mr. Greene has served as our Executive Vice President in October 2013. He served as a consultant to the Company from December 2004 until March 2013, providing technical and marketing analysis for our intellectual property portfolio. Mr. Greene became an employee of Network-1 in March 2013. From April 2006 to February 2009, Mr. Greene served as a marketing consultant for Avatier Corporation, a developer of identity management software. From August 2003 until December 2004, he served as a consultant to Neartek, Inc., a storage management software company (August 2003 until October 2003) and Kavado Inc., a security software company (November 2003 until December 2004). From January 2003 until July 2003, Mr. Greene served as Director of Product Management for FalconStor Software, Inc. (OTC:FALC), a storage management software company. From December 2001 through December 2002, Mr. Greene served as Senior Vice President of Marketing and Business Development of Network-1, at a time when Network-1 was engaged in the development, marketing and licensing of security software. We believe Mr. Greene’s qualifications to serve on our Board include his technical expertise and analysis of our intellectual property and opportunities in the patent, licensing and enforcement business.

Emanuel R. Pearlman has been a member of our Board of Directors since January 2012, where he serves as Chairman of our Audit Committee and a member of our Nominating and Corporate Governance Committee. Mr. Pearlman currently serves as the Chairman and Chief Executive Officer of Liberation Investment Group, a New York based investment management and financial consulting firm, which he founded in January 2003. From March 2022 to April 2022, Mr. Pearlman served as a member of the Board of Directors and Chair of the Strategic Review Committee of Redbox Entertainment, Inc. (NASDAQ:RDBX), an entertainment company that provides consumers access to a large variety of content across digital and physical media. From October 2020 to September 2021, Mr. Pearlman served as a member of the Board of Directors of Atlas Crest Investment Corp. (NYSE:ACIC) and during the period February 2021 until June 2022, he served on the Board of Directors of Atlas Crest Investment Corp. II (NYSE: ACII), each entity is a special purpose acquisition company (SPAC). Mr. Pearlman also serves as Chairman of the Audit Committee and a member of the Compensation Committee and Nomination & Governance Committee of Atlas Crest Investment Corp. and held the same committee positions for Atlas Crest Investment Corp. II during the period February 2021 until June 2022. Mr. Pearlman served as Executive Chairman of Empire Resorts, Inc. (NASDAQ: NYNY) from June 2016 until November 2019, served as Non-Executive Chairman of the Board from September 2010 through May 2016, and served on the Board of Directors from May 2010 to November 2019. Mr. Pearlman was a member of the Board of Directors of CEVA Logistics, AG (SIX:CEVA) from May 2018 until October 2019 and served on its Audit Committee from May 2018 through October 2019 and its Nomination and Governance Committee from May 2018 through May 2019. From June 2013 through May 2018, he served on the Board of Directors of CEVA Holdings, LLC. From May 2017 through September 2017, Mr. Pearlman served on the Board of Directors of ClubCorp Holdings, Inc. (NYSE:MYCC), where he served on the Strategic Review Committee. We believe Mr. Pearlman’s qualifications to serve on our Board include his significant investment and financial experience and expertise combined with his Board experience.

| 9 |

Niv Harizman has been a director of our company since December 2012. Mr. Harizman is a Managing Member of Tyto Capital Partners LLC, a private investment firm specializing in debt and equity investments in middle market companies and special situations, a position he has held since August 2010. Since March 2010, Mr. Harizman has also been the Managing Member of NHK Partners LLC, an entity that makes private investments and provides consulting services. Since November 2013, Mr. Harizman has been affiliated with Riverside Management Group, a merchant banking firm, and BCW Securities LLC, its affiliated broker-dealer. From May 2005 to March 2010, Mr. Harizman was a Founding Partner and Head of Corporate Finance at Plainfield Asset Management LLC, which was a privately held registered investment adviser focused on alternative investments. From May 2000 until May 2005, Mr. Harizman was a member of the Mergers & Acquisitions Group of Credit Suisse First Boston LLC, where he was a Managing Director from 2001-2005 and a Director from 2000 to 2001. From 1995 until 2000, Mr. Harizman was employed by Bankers Trust and its successors including BT Alex. Brown Incorporated and Deutsche Bank in various investment banking positions in the Mergers & Acquisitions Group and Leveraged Finance Group. We believe Mr. Harizman’s qualifications to serve on our Board include his significant investment and financial transactional experience and expertise.

Allison Hoffman has been a director of our company since December 2012. Since August 2020, Ms. Hoffman has served as General Counsel of Phreesia, Inc. (NYSE:PHR), a leading provider of software solutions that healthcare organizations use to manage the patient intake process. From January 2016 until August 2020, Ms. Hoffman served as Chief Legal Officer and Chief Administrative Officer at Intersection Parent, Inc., an urban experience company that utilizes technology to make cities better, including bringing free Wi-Fi throughout New York City. From September 2013 to December 2015, Ms. Hoffman served as Executive Vice President, General Counsel and Corporate Secretary of Martha Stewart Living Omnimedia, Inc. (NYSE:MSO), a media and merchandising company providing consumers with high quality life style content and products. From December 2012 until September 2013, she provided legal services to Martha Stewart Living Omnimedia, Inc. From January 2007 until September 2012, Ms. Hoffman served as Senior Vice President, Chief Legal Officer and Secretary of ALM Media, LLC, a leading provider of specialized news and information for the legal and commercial real estate sectors. We believe that Ms. Hoffman’s qualifications to serve on our Board include her extensive legal background and transactional experience.

| 10 |

CORPORATE GOVERNANCE

Director Independence

Our stock is listed on the NYSE American LLC under the symbol “NTIP”. Three of our current five directors, Emanuel Pearlman, Allison Hoffman and Niv Harizman, are considered independent directors in compliance with the standard of independence in Rule 803A(2) of the NYSE American LLC Company Guide.

Board Leadership Structure

Corey M. Horowitz, our Chairman and Chief Executive Officer, serves as Chairman of our Board of Directors. The Company does not have a lead independent director. The majority of the members of our Board of Directors are independent and all members of Board committees (including Chairpersons) are independent. The Company believes its leadership is appropriate given the size of the Company, the majority of independent directors and the independent leadership of the committees of the Board.

Board Oversight of Risk

With respect to the oversight of the Company’s risk, the Company’s executive officers supervise the day-to-day risk management responsibilities and in turn report, when necessary, to the Audit Committee with respect to financial and operational risk and to the full Board with respect to risks associated with the Company’s overall strategy.

Meetings of the Board of Directors and Board Committees

During the year ended December 31, 2021, our Board held five meetings and acted by unanimous consent in lieu of meeting on one occasion. Board committees held meetings and acted by unanimous consent during the year ended December 31, 2021 as follows: Audit Committee – four meetings and acted by unanimous consent in lieu of meeting on two occasions; Compensation Committee – acted by unanimous consent in lieu of meeting on two occasions; and Nominating and Corporate Governance Committee – one meeting. During 2021, each of our directors attended at least seventy-five percent of the aggregate of: (i) the total number of meetings of the Board of Directors; and (ii) the total number of meetings of all Board committees on which they served.

Our current policy strongly encourages that all of our directors attend all Board and Committee meetings and our Annual Meeting of Stockholders, absent extenuating circumstances that would prevent their attendance. All of our directors attended the Annual Meeting of Stockholders last year.

Board Committees

Our Board of Directors currently has four standing committees: an Audit Committee; a Compensation Committee; a Nominating and Corporate Governance Committee and a Strategic Development Committee. Each of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee has a charter. These charters are available on our website at: http://ir.Network-1.com/governance-docs. Each member of each committee is an “independent” director under the standards of the NYSE American LLC Company Guide. Three of our current five directors, Emanuel Pearlman, Allison Hoffman and Niv Harizman, are considered independent directors in compliance with the standard of independence in Section 803A(2) of the NYSE American LLC Company Guide.

| 11 |

Audit Committee

Our Board of Directors has a separately designated standing audit committee in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended, and Section 803B of the NYSE American LLC Company Guide, consisting of Emanuel Pearlman (Chairman) and Allison Hoffman. Emanuel Pearlman and Allison Hoffman each qualify as an audit committee financial expert under applicable SEC rules. Mr. Pearlman and Ms. Hoffman also qualify as “independent” as independence for audit committee members is defined under Rule 10A-3 of the Securities Exchange Act of 1934, as amended, and Section 803B(2) of the NYSE American LLC Company Guide.

The Audit Committee is appointed by our Board of Directors to provide assistance to the Board in fulfilling its oversight responsibility with respect to, among other things, (i) the integrity of our financial statements, (ii) our compliance with legal and regulatory requirements, (iii) selecting and evaluating the qualifications and independence of our independent registered public accounting firm, (iv) evaluating the performance of our internal audit function and independent registered public accounting firm, and (v) our internal controls and procedures.

Compensation Committee

The Compensation Committee consists of Allison Hoffman (Chairperson) and Niv Harizman. The Compensation Committee is appointed by our Board of Directors to assist the Board in carrying out the Board’s responsibilities relating to compensation of our executive officers and directors. The Compensation Committee has overall responsibility for evaluating and approving the officer and director compensation plans, policies and programs of the Company.

Nominating and Corporate Governance Committee

Our Board has a Nominating and Corporate Governance Committee consisting of Niv Harizman (Chairman) and Emanuel Pearlman. The Nominating and Corporate Governance Committee is responsible for, among other things, developing and recommending to the Board a set of corporate governance policies for the Company, establishing criteria for selecting new directors, and identifying, screening and recruiting new directors. The Committee also recommends to the Board nominees for directors and recommends directors for committee membership to the Board.

Strategic Development Committee

We also have a Strategic Development Committee to assist our Chairman and Chief Executive Officer in strategic development and planning of our business relating to identifying potential strategic partners, acquisition of new IP and other acquisition opportunities. The Committee also assists in capital markets related activities. Niv Harizman is the sole member of the Strategic Development Committee.

| 12 |

Anti-Hedging and Anti-Pledging Policies

Certain transactions in our securities (such as short sales) create a heightened compliance risk or could create the appearance of misalignment between management and stockholders. In addition, securities held in a margin account or pledged as collateral may be sold without consent if the owner fails to meet a margin call or defaults on the loan, thus creating the risk that a sale may occur at a time when an officer or director is aware of material non-public information or otherwise is not permitted to trade in company securities. Our insider trading policies prohibit all directors and executive officers from hedging transactions, buying our securities on margin, or holding such securities in a margin account, buying or selling derivatives on our securities, engaging in short sales involving such securities or pledging our securities as collateral for a loan.

Code of Ethics

We have adopted a Code of Ethics that applies to our executive officers, directors and employees. Copies of our Code of Ethics can be obtained, without charge, upon written request addressed to:

Network-1 Technologies, Inc.

65 Locust Avenue, Third Floor

New Canaan, Connecticut 06840

Attention: Chief Executive Officer

Communications with the Board

The Board of Directors, through its Nominating and Corporate Governance Committee, has established a process for stockholders to send communications to the Board of Directors. Stockholders may communicate with the Board of Directors individually or as a group by writing to: The Board of Directors of Network-1 Technologies, Inc. c/o Corporate Secretary, 65 Locust Avenue, Third Floor, New Canaan, Connecticut 06840. Stockholders should identify their communication as being from a Network-1 stockholder. Our Corporate Secretary may require reasonable evidence that the communication or other submission is made by a Network-1 stockholder before transmitting the communication to our Board of Directors.

CONSIDERATION OF DIRECTOR NOMINEES

Stockholders wishing to recommend director candidates to our Nominating and Corporate Governance Committee must submit their recommendations in writing to the Nominating and Corporate Governance Committee, c/o Corporate Secretary, Network-1 Technologies, Inc., 65 Locust Avenue, Third Floor, New Canaan, Connecticut 06840.

The Nominating and Corporate Governance Committee will consider nominees recommended by Network-1 stockholders provided that the recommendation contains sufficient information for the Nominating and Corporate Governance Committee to assess the suitability of the candidate, including the candidate’s qualifications, and complies with the procedures set forth below under “Deadline and Procedures for Submitting Board Nominations”. In addition, it must include information regarding the recommended candidate relevant to a determination of whether the recommended candidate would be barred from being considered independent under applicable NYSE American LLC rules, or, alternatively, a statement that the recommended candidate would not be so barred. Candidates recommended by stockholders that comply with these procedures will receive the same consideration that candidates recommended by the Nominating and Corporate Governance Committee receive. A nomination which does not comply with the above requirements will not be considered.

| 13 |

The qualities and skills sought in prospective members of the Board are determined by the Nominating and Corporate Governance Committee. When reviewing candidates to our Board, the Nominating and Corporate Governance Committee considers the evolving needs of the Board and seeks candidates that fill any current or anticipated future needs. The Nominating and Corporate Governance Committee generally requires that director candidates be qualified individuals who, if added to the Board, would provide the mix of director characteristics, experience, perspectives and skills appropriate for Network-1. Criteria for selection of candidates will include, but not be limited to: (i) business and financial acumen, as determined by the Nominating and Corporate Governance Committee in its discretion; (ii) qualities reflecting a proven record of accomplishment and ability to work with others; (iii) knowledge of our industry; (iv) relevant experience and knowledge of corporate governance practices; and (v) expertise in an area relevant to Network-1. Such persons should not have commitments that would conflict with the time commitments of a Director of Network-1. Such persons shall have other characteristics considered appropriate for membership on the Board of Directors, as determined by the Nominating and Corporate Governance Committee. While the Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity, the Board and the Nominating and Corporate Governance Committee believe that it is important that the Board members represent diverse viewpoints. In considering candidates for the Board, the Nominating and Corporate Governance Committee and the Board consider the entirety of each candidate’s credentials in the context of the foregoing standards.

DEADLINE AND PROCEDURES FOR SUBMITTING BOARD NOMINATIONS

A stockholder wishing to nominate a candidate for election to our Board of Directors at a meeting of our stockholders must (i) be a stockholder of record at the time of giving of notice provided for in our Bylaws; (ii) be entitled to vote at the meeting; and (iii) comply with the procedures set forth in Section 8 of our Bylaws and applicable law. The required notice must be delivered personally to or mailed to and received by our Corporate Secretary at our principal executive offices (currently located at 65 Locust Avenue, Third Floor, New Canaan, Connecticut 06840), not earlier than the close of business on the 120th day and not later than the 90th day prior to the first anniversary of the preceding year’s annual meeting; provided, however, that, in the event that the date of the annual meeting is more than 30 days before or more than 60 days after such anniversary date, notice by the stockholder to be timely must be so delivered not earlier than the close of business on the 120th day prior to the date of such annual meeting and not later than the close of business on the later of the 90th day prior to the date of such annual meeting; provided, further, in the event that less than 100 days notice of prior public disclosure of the date of the annual meeting is given or made to stockholders, notice by the stockholder to be timely must be received no later than the 10th day following the earlier of (i) the day on which notice of the annual meeting was mailed, or (ii) such public disclosure was first made of the annual meeting. In no event shall any adjournment or postponement of an annual meeting or the announcement thereof commence a new time period for the giving of a stockholder’s notice as described above.

| 14 |

COMPENSATION OF DIRECTORS

In 2021, we compensated each non-management director of our Company by granting to each such outside director an award of 15,000 restricted stock units (each restricted stock unit represents a contingent right to receive one share of our common stock). The restricted stock units vested in equal amounts of 3,750 units on each of March 15, 2021, June 15, 2021, September 15, 2021 and December 15, 2021. In addition, we pay our non-management directors cash director fees of $40,000 per annum ($10,000 per quarter). Non-management directors also receive additional cash compensation on an annual basis for serving on the following Board committees: Audit Committee – Chairperson receives $7,500 and members receive $5,000 and the Chairperson and member of each of the Compensation Committee and Nominating and Corporate Governance Committee receives annual fees of $3,750 and $2,500, respectively.

The Board of Directors, based upon the recommendation of the Compensation Committee, may review and determine the form and amount of directors’ compensation, including cash, equity-based awards and other director compensation to maintain a transparent and readily understandable director compensation which ensures that the directors continue to receive fair and appropriate compensation for the time commitment required to discharge their duties for a company of our size.

The following table sets forth the compensation awarded to, earned by or paid to all persons who served as members of our Board of Directors other than our Named Executive Officers (as defined on page 17 hereof) during the year ended December 31, 2021. No director who is also a Named Executive Officer received any compensation for services as a director in 2021.

Name |

Fees

earned or |

Stock

Awards |

All

other |

Total |

| Emanuel Pearlman | $50,000 | $46,988 | $1,125 | $98,113 |

| Niv Harizman | $46,250 | $46,988 | $1,125 | $94,363 |

| Allison Hoffman | $48,830 | $46,988 | $1,125 | $96,943 |

___________________________

| (1) | Represents director’s fees payable in cash to each non-management director of $10,000 per quarter (or $40,000 per annum) for 2021 plus additional cash fees for serving on Board committees as disclosed above. |

| (2) | The amounts included in this column represent the grant date fair value of restricted stock unit awards (RSUs) granted to directors, computed in accordance with FASB ASC Topic 718. For a discussion of valuation assumptions see Note B[10] to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2021. The 15,000 RSUs granted to each non-management director vested on a quarterly basis beginning March 15, 2021. Each restricted stock unit represents the contingent right to receive one share of our common stock. |

| (3) | As of December 31, 2021, no stock options, RSUs or other awards were owned by any of the above referenced directors. |

| (4) | Represents payment of dividends (dividend equivalent rights) on RSUs for 2021. |

| 15 |

EXECUTIVE OFFICERS

All officers serve at the direction of our Board of Directors. The Board elects our officers.

Our executive officers are Corey M. Horowitz, our Chairman and Chief Executive Officer, David Kahn, our Chief Financial Officer and Secretary, and Jonathan Greene, our Executive Vice President. See backgrounds of Mr. Horowitz and Mr. Greene on page 9 of this Proxy Statement. The background of David Kahn, our Chief Financial Officer and Secretary, currently serves on our Board of Directors but is not a nominee for election at the 2022 Annual Meeting, is as follows:

David C. Kahn, CPA, age 70, has been our Chief Financial Officer since January 2004 and our Secretary since August 2012. Mr. Kahn was elected to our Board in April 2012. Since December 1989, Mr. Kahn has provided accounting and tax services on a consulting basis to private and public companies. From August 2000 until August 2012, Mr. Kahn served as a full-time faculty member of Yeshiva University in New York.

EXECUTIVE COMPENSATION

Named Executive Officers

For the year ended December 31, 2021, we have determined that (i) our Chief Executive Officer, and (ii) our most highly compensated executive officers other than our Chief Executive Officer who served in such capacity during 2021 and at the end of 2021 whose total compensation exceeded $100,000, are our Named Executive Officers (as defined on page 17), as follows:

Corey M. Horowitz, Chairman and Chief Executive Officer;

David Kahn, Chief Financial Officer; and

Jonathan Greene, Executive Vice President.

Compensation Overview

Network-1 Technologies, Inc. is a “smaller reporting company” under the rules promulgated by the Securities and Exchange Commission and the Company complies with the disclosure requirements applicable to smaller reporting companies. Accordingly, this executive compensation summary is not intended to meet the “Compensation Disclosure and Analysis” disclosure required of larger reporting companies.

Role of the Compensation Committee. All compensation for our Named Executive Officers is determined by the Compensation Committee of our Board of Directors which is composed only of independent directors. The Compensation Committee is responsible for reviewing the performance and establishing the total compensation of our Named Executive Officers on an annual basis. The Compensation Committee administers compensation plans for our Named Executive Officers and is responsible for recommending grants of equity awards under our stock incentive plan to the Board of Directors for approval. Our Chairman and Chief Executive Officer annually makes recommendations to the Compensation Committee regarding base salary, bonus compensation and equity awards for the other Named Executive Officers. Such recommendations are considered by the Compensation Committee; however, the Compensation Committee retains full discretion and authority over the final compensation decisions for our Named Executive Officers. The Compensation Committee has a formal written charter which is available on our website.

| 16 |

Advisory Vote on Executive Compensation. At our September 2021 annual meeting of stockholders, we held a stockholder advisory vote on the compensation of our Named Executive Officers, commonly referred to as a say-on-pay vote. Our stockholders approved the compensation of our Named Executive Officers at the September 2021 annual meeting, with a majority of stockholder votes cast in favor of our say-on-pay resolution. As we evaluated our compensation practices, we were mindful of the support our stockholders expressed for our compensation practices. As a result, following our annual review of our executive compensation, the Compensation Committee decided to retain our general approach to executive compensation. Our executive compensation for 2021 advances our retention goals and promotes both short-term and long-term performance of our executive officers and reflects our financial performance.

Summary Compensation Table

The following table summarizes compensation for the years ended December 31, 2021 and December 31, 2020, awarded to, earned by or paid to our Chief Executive Officer (“CEO”) and to each of our executive officers who received total compensation in excess of $100,000 for the year ended December 31, 2021 for services rendered in all capacities to us (collectively, the “Named Executive Officers”).

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards($)(3) | All

Other Compensation($)(1) | Total($) | |||||||||||||||||

| Corey M. Horowitz | 2021 | $ | 535,000 | $ | 1,976,000 | (2) | $ | — | $ | 38,500 | (4) | $ | 2,549,500 | ||||||||||

| Chairman and Chief Executive Officer | 2020 | $ | 527,000 | $ | 345,000 | (2) | $ | — | $ | 81,250 | (4) | $ | 953,250 | ||||||||||

| David C. Kahn | 2021 | $ | 175,000 | $ | 22,500 | $ | — | $ | 29,291 | (5) | $ | 226,791 | |||||||||||

| Chief Financial Officer | 2020 | $ | 175,000 | $ | 15,000 | $ | 25,200 | (3) | $ | 34,828 | (5) | $ | 250,028 | ||||||||||

| Jonathan Greene | 2021 | $ | 200,000 | $ | 40,000 | $ | — | $ | 36,120 | (6) | $ | 276,120 | |||||||||||

| Executive Vice President | 2020 | $ | 200,000 | $ | 25,000 | $ | 33,600 | (3) | $ | 43,000 | (6) | $ | 301,600 | ||||||||||

| ______________________________________________ |

| (1) | We have concluded that the aggregate amount of perquisites and other personal benefits paid in 2021 and 2020 to either Mr. Horowitz, Mr. Kahn or Mr. Greene did not exceed $10,000. |

| (2) | Mr. Horowitz received the following cash incentive bonus payments for 2021: (i) an annual discretionary bonus of $175,000 and (ii) incentive bonus compensation of $1,801,000 pursuant to his employment agreement (see “Employment Agreements-Termination of Employment and Change In-Control Arrangements” below). Mr. Horowitz received the following cash incentive bonus payments for 2020: (i) an annual discretionary bonus of $125,000 and (ii) incentive bonus compensation of $220,000 pursuant to his employment agreement. |

| (3) | The amounts in this column represent the aggregate grant date fair value of restricted stock units awards granted to the Named Executive Officers computed in accordance with FASB ASC Topic 718. In accordance with SEC rules, the grant date fair value of an award that is subject to a performance condition is based on the probable outcome of the performance condition. See Note B[10] to our consolidated financial statements included in our Annual Report for a discussion of the assumptions made by the Company in determining the grant date fair value. |

| (4) | Includes 401 (k) matching funds contributions by the Company and profit sharing under the Company's 401 (k) Plan for the benefit of Mr. Horowitz of $38,500 for 2021 and $37,500 for 2020, respectively. Also includes dividends (dividend equivalent rights) on restricted stock units owned by Mr. Horowitz for 2021 of $-0- and 2020 of $43,750. |

| 17 |

| (5) | Includes 401 (k) matching funds contributions by the Company and profit sharing under the Company's 401 (k) Plan for the benefit of Mr. Kahn of $28,728 for 2021 and $30,453 for 2020. Also includes dividends (dividend equivalent rights) on restricted stock units owned by Mr. Kahn for 2021 and 2020 of $563 and $4,375, respectively. |

| (6) | Represents 401 (k) matching funds contributions by the Company and profit sharing under the Company's 401 (k) Plan for the benefit of Mr. Greene of $35,201 for 2021 and $37,500 for 2020. Also includes dividends (dividend equivalent rights) on restricted stock units owned by Mr. Greene for 2021 and 2020 of $919 and $5,500, respectively. |

Narrative Disclosure to Summary Compensation Table

Employment Agreements, Termination of Employment and Change-In-Control Arrangements

On March 22, 2022, we entered into a new employment agreement (“Agreement”) with Corey M. Horowitz, our Chairman and Chief Executive Officer, pursuant to which he continues to serve as our Chairman and Chief Executive Officer for a four year term (“Term”), at an annual base salary of $535,000 which shall be increased by 3% per annum during the Term. The Agreement established an annual target bonus of $175,000 for our Chairman and Chief Executive Officer based upon performance. During the year ended December 31, 2021 and December 31, 2020, our Chairman and Chief Executive Officer received an annual discretionary bonus of $175,000 and $125,000, respectively.

In addition, pursuant to the Agreement, we granted to our Chairman and Chief Executive Officer, under our 2013 Stock Incentive Plan (“2013 Plan”), 600,000 restricted stock units (the “RSUs”, each RSU awarded by us to our officers, directors and consultants represents a contingent right to receive one share of our common stock) which terms provided for vesting in four tranches, as follows: (1) 175,000 RSUs of which 100,000 RSUs shall vest on March 22, 2023 and 75,000 RSUs shall vest on March 22, 2024, subject to Mr. Horowitz’s continued employment by us through each such vesting date (the “Employment Condition”) (“Tranche 1”); (2) 150,000 RSUs shall vest if at any time during the Term our common stock (the “Common Stock”) achieves a closing price for twenty (20) consecutive trading days (“Closing Price”) of a minimum of $3.50 per share (subject to adjustment for stock splits) and the Employment Condition is satisfied through the date such minimum per share Closing Price is achieved (“Tranche 2”); (3) 150,000 RSUs shall vest if at any time during the Term of the Agreement our Common Stock achieves a Closing Price (as defined above) of a minimum of $4.00 per share (subject to adjustment for stock splits) and the Employment Condition is satisfied through the date such minimum per share Closing Price is achieved (“Tranche 3”); and (4) 125,000 RSUs shall vest if at any time during the term of the Agreement, our Common Stock achieves a Closing Price of a minimum of $4.50 per share (subject to adjustment for stock splits) and the Employment Condition is satisfied through the date such minimum per share Closing Price is achieved (“Tranche 4”). In the event of a Change of Control (as defined), Termination Other Than for Cause (as defined) or a termination by Mr. Horowitz for Good Reason (as defined) in each case prior to the last day of the Term, the vesting of all RSUs (Tranches 1, 2, 3 and 4) shall accelerate (and not be subject to any conditions) and all RSUs shall become immediately fully vested. All RSUs granted by us to our officers, directors or consultants have dividend equivalent rights.

Under the terms of the Agreement, so long as Mr. Horowitz continues to serve as an executive officer of the Company, whether pursuant to the Agreement or otherwise, Mr. Horowitz shall also receive incentive compensation in an amount equal to 5% of our gross royalties or other payments from Licensing Activities (as defined) (without deduction of legal fees or any other expenses) with respect to our Remote Power Patent and a 10% net interest (gross royalties and other payments after deduction of all legal fees and litigation expenses related to licensing, enforcement and sale activities, but in no event shall he receive less than 6.25% of the gross recovery) of our royalties and other payments relating to Licensing Activities with respect to patents other than our Remote Power Patent (including all of our existing patent portfolios and our investment in ILiAD Biotechnologies) (collectively, the “Incentive Compensation”). During the year ended December 31, 2021 and December 31, 2020, Mr. Horowitz earned Incentive Compensation of $1,801,000 and $220,000, respectively.

| 18 |

The Incentive Compensation shall continue to be paid to Mr. Horowitz for the life of each of our patents with respect to licenses entered into with third parties during the Term or at any time thereafter, whether he is employed by us or not; provided, that, the employment of Mr. Horowitz has not been terminated by us “For Cause” (as defined) or terminated by him without “Good Reason” (as defined). In the event of a merger or sale of substantially all of our assets, we have the option to extinguish the right of Mr. Horowitz to receive future Incentive Compensation by payment to him of a lump sum payment, in an amount equal to the fair market value of such future interest as determined by an independent third party expert if the parties do not reach agreement as to such value. In the event that Mr. Horowitz’s employment is terminated by us “Other Than For Cause” (as defined) or by him for “Good Reason” (as defined), Mr. Horowitz shall also be entitled to (i) a lump sum severance payment of 12 months base salary, (ii) a pro-rated portion of the $175,000 target bonus provided bonus criteria have been satisfied on a pro-rated basis through the calendar quarter in which the termination occurs and (iii) accelerated vesting of all unvested options, RSUs or other awards.

In connection with the Agreement, Mr. Horowitz has also agreed not to compete with us as follows: (i) during the Term and for a period of 12 months thereafter if his employment is terminated “Other Than For Cause” (as defined) provided he is paid his 12 month base salary severance amount and (ii) for a period of two years from the termination date, if terminated “For Cause” by us or “Without Good Reason” by Mr. Horowitz.

David Kahn serves as our Chief Financial Officer on an at-will basis at a current annual base salary of $175,000. Mr. Kahn received a discretionary annual bonus of $22,500 for 2021 and $15,000 for 2020. On December 29, 2020, Mr. Kahn was granted 7,500 RSUs under the 2013 Plan, 50% of such RSUs vested on the one year anniversary of the grant (December 29, 2021) and 50% of such RSUs vest on the two year anniversary of the grant (December 29, 2022) subject to his continued employment. In addition, in the event Mr. Kahn’s employment is terminated without “Good Cause” (as defined), he shall receive (i) (a) 6 months base salary or (b) 12 months base salary in the event of a termination without “Good Cause” within 6 months following a “Change of Control” of the Company (as defined) and (ii) accelerated vesting of all remaining unvested shares underlying his options, RSUs or any other awards he may receive in the future.

Jonathan Greene serves as our Executive Vice President on an at-will basis at an annual base salary of $200,000. Mr. Greene received a discretionary annual bonus of $40,000 for 2021 and $25,000 in 2020. On December 29, 2020, Mr. Greene was granted 10,000 RSUs under the 2013 Plan, 50% of such RSUs vested on the one year anniversary of the date of grant (December 29, 2021) and 50% of such RSUs vest on the two year anniversary of the grant (December 29, 2022) subject to his continued employment. On January 18, 2022, Mr. Greene was granted 15,000 RSUs under the 2013 Plan, 50% of such RSUs vest on the one year anniversary of the date of grant (January 18, 2023) and 50% of such RSUs vest on the two year anniversary of the grant (January 18, 2024).

| 19 |

Profit Sharing 401(k) Plan

We offer all employees who have completed a year of service (as defined) participation in a 401(k) retirement savings plan. 401(k) plans provide a tax-advantaged method of saving for retirement. We expensed matching contributions and profit sharing of $102,500 and $105,500 under the 401(k) plan for the years ended December 31, 2021 and 2020, respectively.

OUTSTANDING EQUITY AWARDS AT YEAR-END

Outstanding Equity Awards at December 31, 2021

The following table sets forth information relating to unexercised options and unvested restricted stock units for each Named Executive Officer as of December 31, 2021:

Option Awards |

Stock Awards | |||||

Name |

Number

of Securities |

Option Exercise Price ($) |

Option Expiration Date |

Equity incentive plan awards: Number of unearned shares, units or other rights that have not vested |

Equity incentive plan awards: Market value of unearned shares, units or other rights that have not vested(1) ($) | |

Exercisable |

Unexercisable | |||||

| Corey M. Horowitz Chairman and CEO |

500,000 | —

|

$1.19

|

11/01/22

|

— | $ — |

David Kahn

|

—

|

— |

—

|

— |

3,750(2) | $10,575 |

| Jonathan Greene Executive Vice President |

— | — | — | — | 5,000(3) | $14,100 |

_____________________________

| (1) | In accordance with SEC rules, market value is based on $2.82 per share representing the closing price of our common stock on the last trading day of the year. |

| (2) | Represents 3,750 restricted stock units, which vest on December 29, 2022, subject to Mr. Kahn’s continued employment by us. |

| (3) | Represents 5,000 restricted stock units, which vest on December 29, 2022, subject to Mr. Greene’s continued employment by us. |

| 20 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth information regarding the beneficial ownership of our common stock as of July 15, 2022 for (i) each of our directors, (ii) each of our executive officers, (iii) each person known by us to be the beneficial owner of more than 5% of our outstanding shares of common stock, and (iv) all of our executive officers and directors as a group.

NAME AND ADDRESS OF BENEFICIAL OWNER |

AMOUNT AND NATURE OF BENEFICIAL |

PERCENTAGE | |

Executive Officers and Directors: Corey M. Horowitz(3) |

7,016,751 |

28.9% | |

| CMH Capital Management Corp.(4) | 2,291,372 | 9.6% | |

| Niv Harizman(5) | 279,735 | 1.2% | |

| David C. Kahn(6) | 116,053 | * | |

| Emanuel Pearlman(7) | 105,809 | * | |

| Jonathan E. Greene(8) | 85,717 | * | |

| Allison Hoffman(9) | 68,061 | * | |

| All

officers and directors as a group (6 Persons) |

7,672,126 | 31.6% | |

| 5% Stockholders: | |||

| Steven D. Heinemann(10) | 1,961,201 | 8.2% | |

| Goose Hill Capital LLC(11) | 1,376,068 | 5.8% |

__________________________

* Less than 1%.

| (1) | Unless otherwise indicated, we believe that all persons named in the above table have sole voting and investment power with respect to all shares of our common stock beneficially owned by them. Unless otherwise indicated, the address for each listed beneficial owner is c/o Network-1 Technologies, Inc., 65 Locust Avenue, Third Floor, New Canaan, Connecticut 06840. |

| (2) | A person is deemed to be the beneficial owner of shares of common stock that can be acquired by such person within 60 days from July 15, 2022 upon the exercise of stock options or restricted stock units that vest within such 60 day period. Each beneficial owner's percentage ownership is determined by assuming that all stock options and restricted stock units held by such person (but not those held by any other person) and which are exercisable or vest within 60 days from July 15, 2022 have been exercised or vested. Assumes a base of 23,791,194 shares of our common stock outstanding as of July 15, 2022. |

| 21 |

| (3) | Includes (i) 3,703,368 shares of common stock held by Mr. Horowitz, (ii) 500,000 shares of common stock subject to currently exercisable stock options held by Mr. Horowitz, (iii) 2,157,097 shares of common stock held by CMH Capital Management Corp., an entity solely owned by Mr. Horowitz, (iv) 134,275 shares of common stock owned by the CMH Capital Management Corp. Profit Sharing Plan, of which Mr. Horowitz is the trustee, (v) 67,470 shares of common stock owned by Donna Slavitt, the wife of Mr. Horowitz, (vi) an aggregate of 452,250 shares of common stock held by two trusts and a custodian account for the benefit of Mr. Horowitz’s three children, and (vii) 2,291 shares of common stock held by Horowitz Partners, a general partnership of which Mr. Horowitz is a partner. Does not include 600,000 shares of common stock subject to restricted stock units owned by Mr. Horowitz that do not vest within 60 days of July 15, 2022. |

| (4) | Includes 2,157,097 shares of common stock owned by CMH Capital Management Corp. and 134,275 shares of common stock owned by CMH Capital Management Corp. Profit Sharing Plan. Corey M. Horowitz, by virtue of being the sole officer, director and shareholder of CMH Capital Management Corp. and the trustee of the CMH Capital Management Corp. Profit Sharing Plan, has the sole power to vote and dispose of the shares of common stock owned by CMH Capital Management Corp. and the CMH Capital Management Corp. Profit Sharing Plan. |

| (5) | Includes 279,735 shares of common stock. Does not include 7,500 shares of common stock subject to restricted stock units owned by Mr. Harizman that do not vest within 60 days from July 15, 2022. |

| (6) | Includes 116,053 shares of common stock. Does not include 3,750 shares of common stock subject to restricted stock units owned by Mr. Kahn that do not vest within 60 days from July 15, 2022. |

| (7) | Includes 105,809 shares of common stock. Does not include 7,500 shares of common stock subject to restricted stock units owned by Mr. Pearlman that do not vest within 60 days from July 15, 2022. |

| (8) | Includes 85,717 shares of common stock. Does not include 20,000 shares of common stock subjected to restricted stock units owned by Mr. Greene that do not vest within 60 days from July 15, 2022. |

| (9) | Includes 68,061 shares of common stock. Does not include 7,500 shares of common stock subject to restricted stock units owned by Ms. Hoffman that do not vest within 60 days from July 15, 2022. |

| (10) | Includes 585,133 shares of common stock owned by Mr. Heinemann and 1,376,068 shares of common stock owned by Goose Hill Capital LLC. Goose Hill Capital LLC is a limited liability company of which Mr. Heinemann is the sole member. Mr. Heinemann, by virtue of being the sole member of Goose Hill Capital LLC, has the sole power to vote and dispose of the shares of common stock owned by Goose Hill Capital LLC. The aforementioned beneficial ownership is based upon Amendment No. 9 to Schedule 13G filed by Mr. Heinemann with the SEC on February 4, 2022. The address for Mr. Heinemann is c/o Goose Hill Capital, LLC, 12378 Indian Road, North Palm Beach, Florida 33408. |

| (11) | Includes 1,376,068 shares of common stock. Steven D. Heinemann, by virtue of being the sole member of Goose Hill Capital LLC, has the sole power to vote and dispose of the shares of common stock owned by Goose Hill Capital LLC. The aforementioned beneficial ownership is based upon Amendment No. 9 to Schedule 13G filed by Mr. Heinemann with the SEC on February 4, 2022. The address for Goose Hill Capital LLC is 12378 Indian Road, North Palm Beach, Florida 33408. |

| 22 |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

On May 27, 2021, the Company repurchased from Emanuel Pearlman, a director of the Company, 40,000 shares of its common stock at a purchase price of $3.27 per share for an aggregate purchase price of $130,800.

Review, Approval or Ratification of Transactions with Related Persons

The Audit Committee has responsibility for reviewing and approving related-persons transactions in accordance with its charter. A related person is any executive officer, director, nominee for director or more than 5% stockholder of the Company, including immediate family members, and any entity owned or controlled by such persons. In addition, pursuant to our Code of Ethics, all of our officers, directors and employees are to avoid conflicts of interest and to refrain from taking part or exercising influence in any transaction in which such party’s personal interest may conflict with the best interest of the Company. Except for provisions of the Audit Committee Charter, there are no written procedures governing review of related-persons transactions.

AUDIT COMMITTEE REPORT

The information contained in this Audit Committee report shall not be deemed to “soliciting material” and has not been “filed” with the SEC. This report will not be incorporated by reference into any of our future filings under the Securities Act of 1933 or the Exchange Act, except to the extent that we may specifically incorporate it by reference into a future filing.

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board. Management is responsible for the financial statements and the reporting process, including the internal control over financial reporting. The Company’s independent registered public accounting firm, Friedman LLP, is responsible for expressing an opinion on the conformity of the audited financial statements with U.S. generally accepted accounting principles. The Audit Committee has reviewed and discussed the audited financial statements with management and management’s evaluations of the Company’s system of internal controls over financial reporting contained in the 2021 Annual Report on Form 10-K.

As required by the standards of the Public Company Accounting Oversight Board (“PCAOB”), the Committee has discussed with Friedman LLP (i) the matters required to be discussed by the applicable requirements of the PCAOB and the SEC and (ii) the independence of Friedman LLP from the Company and management. The Audit Committee received the written disclosures and the confirming letter from Friedman LLP required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence and discussed with Friedman LLP its independence from the Company.

Based upon the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2021 which was filed with the SEC on March 30, 2022.

The Audit Committee – Emanuel Pearlman (Chairman) and Allison Hoffman

| 23 |

PROPOSAL 2

APPROVAL OF

THE NETWORK-1 TECHNOLOGIES, INC.

2022 STOCK INCENTIVE PLAN

Proposal